Hey, what's up family? It is your favorite uncle cousin, Tyrone Gregory, the self-employed tax guru. But today's video, I am going to be talking about the all-new 1040. You know, 2019 is just a couple of days away, and speaking of them, if I don't hear from you or speak to you between now and next year, let me wish you, your family, and your business a very prosperous new year. 2019 should be the year to break in the dough. Okay, that is what I want you to do in 2019, but I just want to come to you today real quick, honor. I don't want to be before you long. I just want to talk about this new 1040, right? So, as some of you may know, or may not have known, back in September of 2017, there was this big talk about tax reform and how we're going to be able to file our taxes on a postcard and things like that. And then in December, the President signed the new tax reform bill, the tax cuts and Jobs Act. Well, not surprisingly, they actually kept their promise. We now have a new 1040, and it's not quite postcard size. I'm gonna show it to you here in a second, but it is definitely not quite the postcard size. And there are a few things I want you to be aware of. The first thing is, to be aware of this, if you file using software, if you file using a tax preparer or something like that, you really should not see any differences. You really should not see any type of noticeable difference or changes in what you file. You'll still be able to put the same information and get hopefully the same exact results. Now, for...

Award-winning PDF software

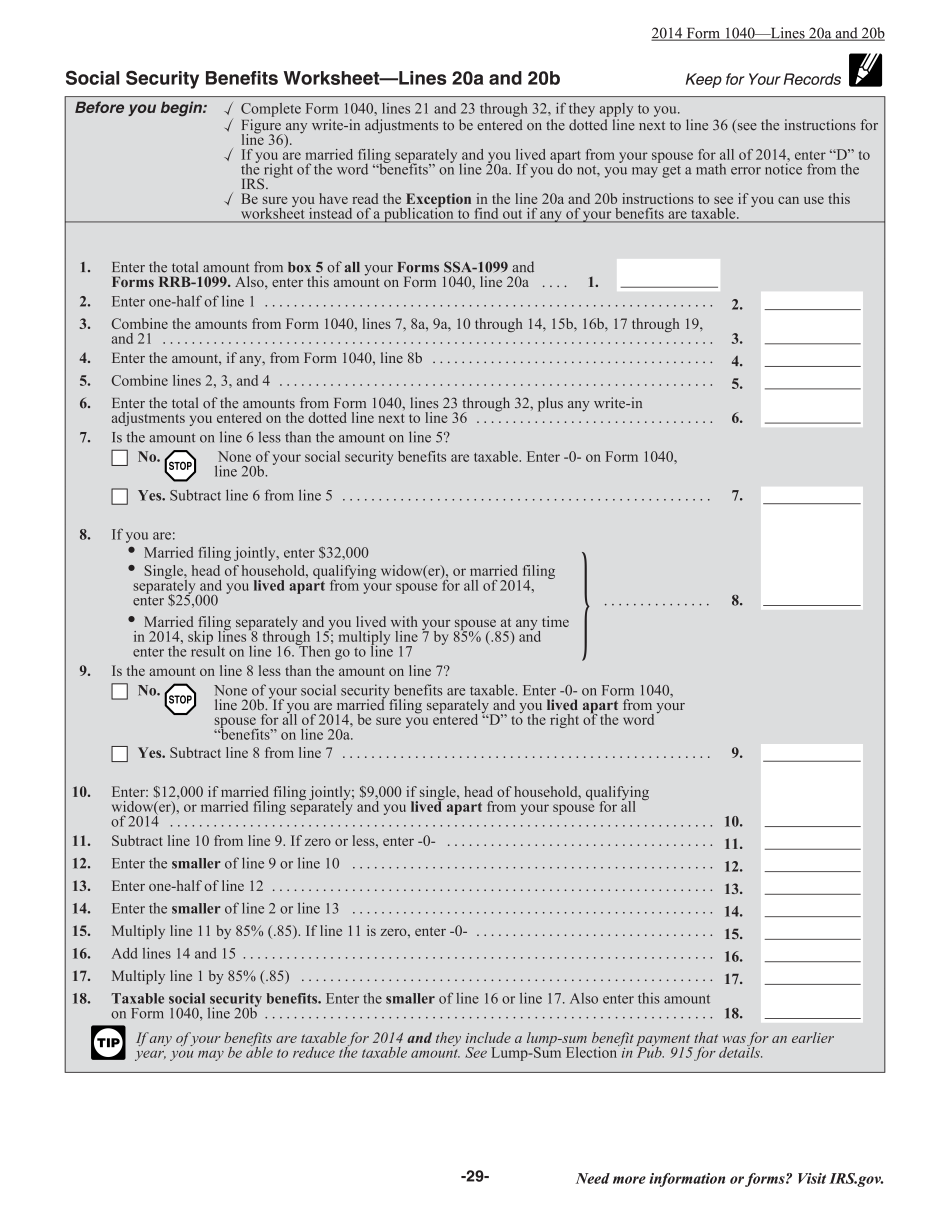

instruction 1040 Line 20a & 20b Form: What You Should Know

Line 1b — Social Security Benefit This line shows the amount of benefits included on line 1a. Enter the total amount of social security benefits included. Line 1c — Social Security Benefits Net income This line shows the amount of net income included on line 1a. Line 1d — Social Security Benefits Inflation Adjustment This line shows the amount of the difference in cost of living since the end of the tax year shown in line 1a. Line 2a — Other Taxable Income Add up all other taxable income you have that is included on line 2a. Multiply this amount by a percentage equal to the total additional tax you will have included on line 1a (plus federal income tax withholding) — the tax you will have paid in the previous year. This is your taxable income for the year. Line 2b — Other Taxable Income The amount to add to line 2b (dividends, interest and capital gains) if you are not claiming the earned income credit. Line 3a — Other Taxable Income Add up all other taxable income you are claiming on line 3a. Multiply this amount by a percentage equal to the total additional tax you will have included on line 2a (plus federal income tax withholding) — the tax you will have paid in the previous year. This is your taxable income for the year. Line 3b — Expenses and Student loan amount This line shows any expenses you incurred in the previous tax year. Multiply this amount by a percentage equal to the amount of income, gain or loss you are not claiming as a refund on line 3a (including capital losses). Subtract this figure from your income, gain or loss. If the amount is negative, subtract 10% from line 3a. Line 3c — Other Expenses This line shows any other expenses incurred in the previous tax year. Multiply this amount by a percentage equal to the amount of income, gain or loss you are not claiming as a refund on line 3a (including capital losses). Subtract this figure from your income, gain or loss. Line 3d — Student Loan Payment The amount to add to line 3d (for payment of your student loans). Enter your current monthly payment amount on line 3a and calculate your student loan interest.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form instruction 1040 Line 20a & 20b, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form instruction 1040 Line 20a & 20b online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instruction 1040 Line 20a & 20b by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instruction 1040 Line 20a & 20b from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Form instruction 1040 Line 20a & 20b