Award-winning PDF software

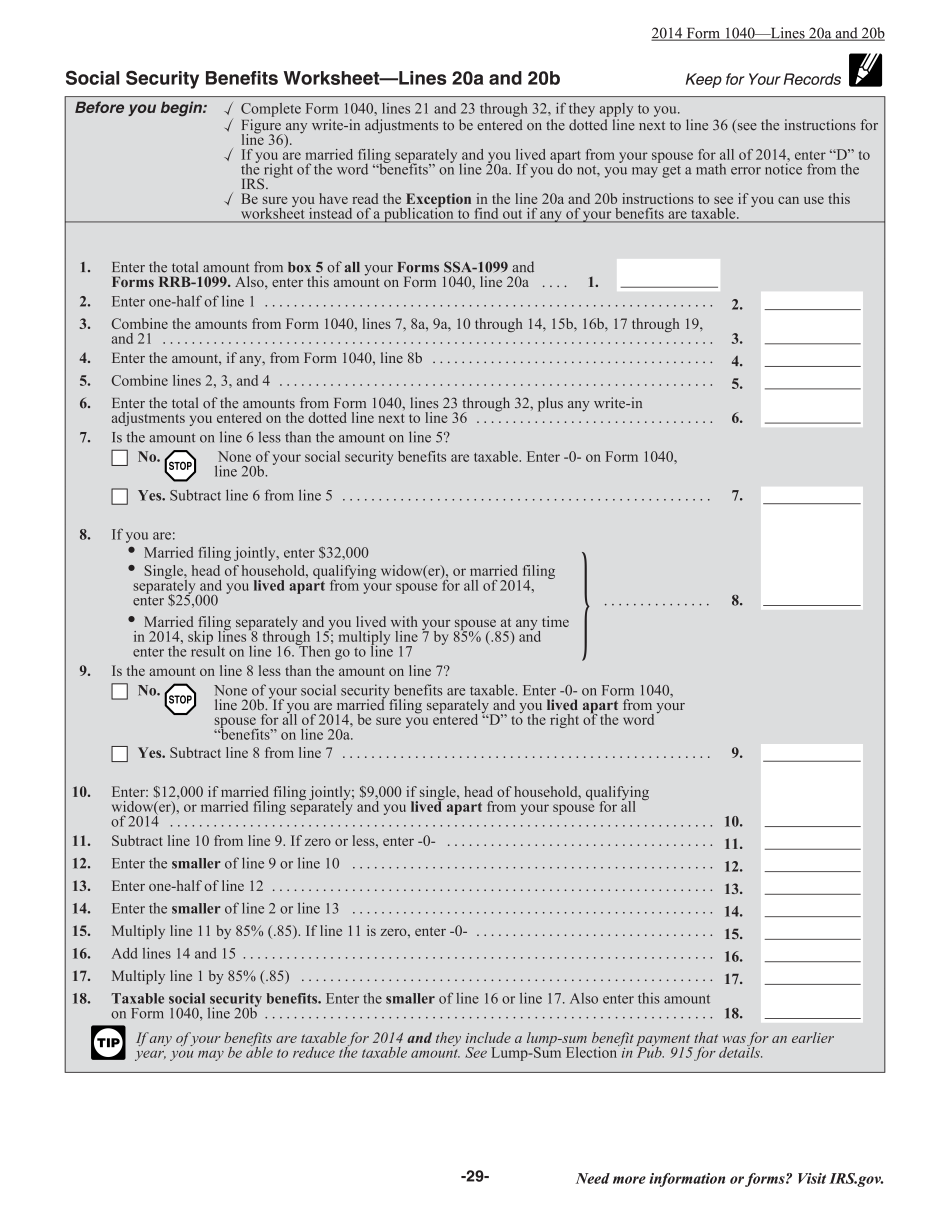

What is instruction 1040 Line 20a & 20b Form: What You Should Know

A detailed exam guide is available for each exam. A. An application must be filled out and signed in its entirety, including information as to the individual's name, date of birth and gender. B. A written statement from an employer or their representative must be submitted, explaining the need for the individual to work for that company or individual. C. Applicant applicants must attest that any information furnished in connection with the application is true and correct, including any false statements concerning their criminal and/or educational history. The individual must also sign a “Declaration of Employment and Acceptance.” D. The Application must be signed, in its entirety, by the applicant and cannot be amended, altered, or materially changed. The individual is to provide a birth certificate or other document issued by the U.S. Federal Government for an individual who is 19 years old or older. If an individual is 18 years old or older on the date of the application, the Individual must provide a signed, notarized statement from a parent or legal guardian, stating that the individual is at least 19 years old on the date of application. D. The Individual must supply their own vehicle for a journey that will result in continuous overnight transportation. E. The individual's application may contain any or all of the following: A. A completed application form that consists of all information necessary to complete the application. This is to be submitted at the time of application. Please note that not all the information requested can be found within a standard application. B. A personal identification number (PIN). C. A photocopy or photographic reproduction of a valid Department issued ID such as a driver's license, student ID or military ID. D. Valid Social Security Number, which is used as an identification number for Social Security and for all Department programs and activities. E. A copy of their last school record (high school or equivalent); F. A copy of their recent and current school academic records; G. For applicants 16-17 years old, written acknowledgment of their parent or legal guardian, and written permission by the parent or legal guardian to be present during the review process. They must allow a Department of Human Resources representative to sign the original authorization. H. A current valid school photo identification. I. A copy of the person's current Driver's license or student ID. J.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form instruction 1040 Line 20a & 20b, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form instruction 1040 Line 20a & 20b online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instruction 1040 Line 20a & 20b by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instruction 1040 Line 20a & 20b from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.