Good morning, everyone. This is the Med City CPA. We're going through the Form 1040 instructions and want to talk about IRA distributions. You should receive a 1099 showing the total amount of distributions from your IRA before income tax or other deductions are withheld. Generally, if you receive the form, you enter the data. However, there are some exceptions. So what happens if you rolled over part or all of your distributions from one Roth IRA to another Roth IRA or to an IRA other than a Roth IRA, or to a qualified plan or other eye right other than a Roth IRA? You also enter "rollover" next to line 4B. If the distribution was rolled over, enter zero on line 4B. If the total distribution wasn't rolled over, enter the part not rolled over on line 4B unless exception two applies, which are explained below. Generally, a rollover must be made within 60 days after the day you receive the distributions. You can't hold on to the cash forever. If you rolled over the distribution to a qualifying plan or converted it over in 2019, include a statement explaining what you did. Now, here's exception number two. If any of the following apply, enter the total distribution on line 4A and C Form 80606 and its instructions to figure the amount to enter on line 4B. 1. You received a distribution from an IRA other than a Roth IRA and you made non-deductible contributions to any of your traditional, set, or SEP IRAs for 2018 or an earlier year. 2. You made a non-deductible contribution to the Azurri eye arrays for 2018. 3. You received a distribution from a Roth IRA and the distribution code Q is shown on 7 of Form 1098-R. These exceptions are stated in the Form 1040 instructions, specifically on page...

Award-winning PDF software

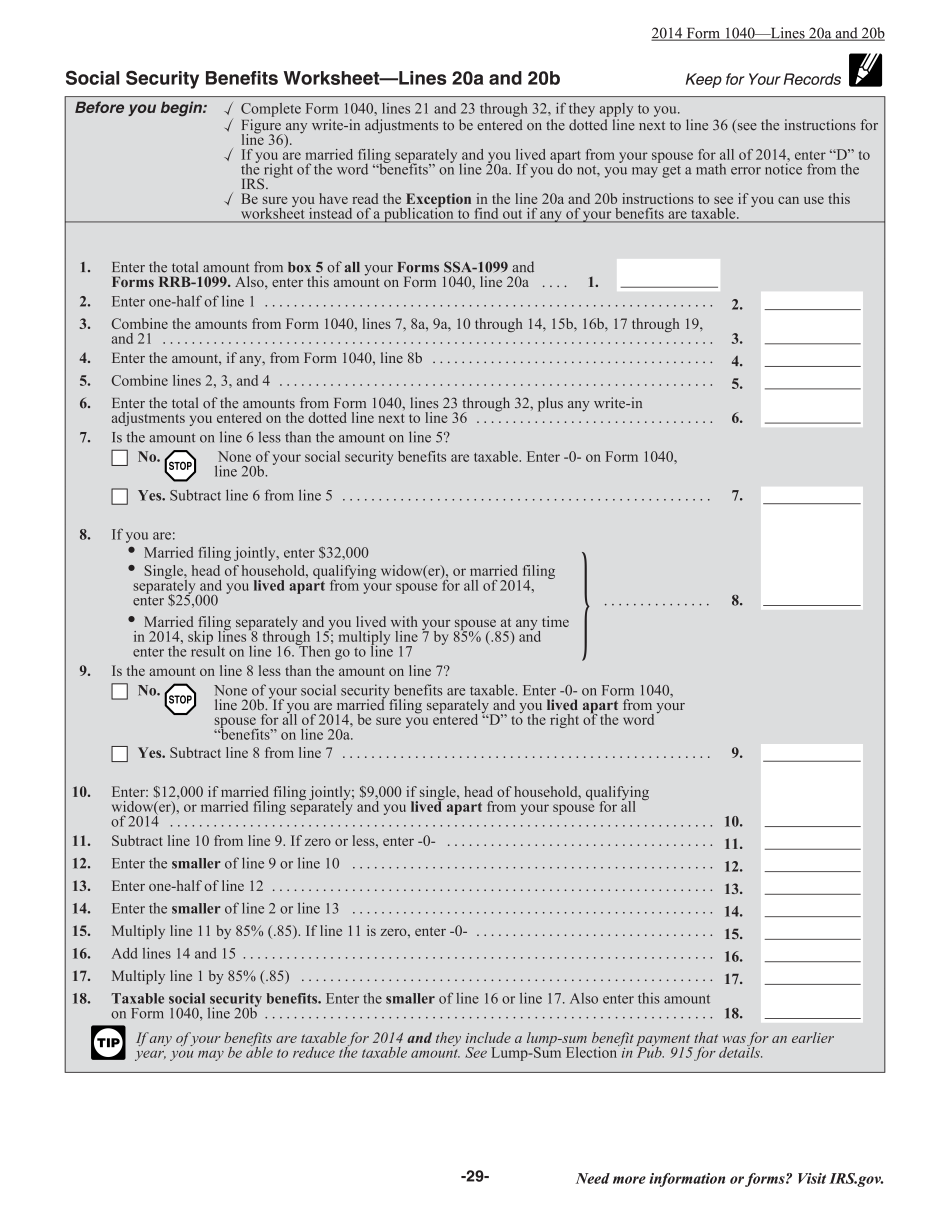

When to file instruction 1040 Line 20a & 20b Form: What You Should Know

Line 22 — New York state exclusion. If you have no New York State income tax withheld from your pay, enter 1. Page 2, Column1 — Enter your NYS non-exempt Social Security Tax. If you are filing an F-4, enter. If you are filing an F-5, enter. Paying State income tax for your partner's portion of your NYS non-exempt Social Security Tax — Line 22. Use line number 2a if you are an F-4, 3 if you are an F-5, Line 25 — Enter the NYS New York City income tax withholding. For a single person, enter 1 if none of the following applies: You are married and file a joint return, enter 1 if both of you file a joint return and your NYS non-exempt Line 26 — Enter your NYS Non-exempt Social Security Tax. The NYS New York City tax withholding schedule will be used to determine how much NYS Non-Exempt Social Security Tax you will pay. Line 27 — Form 8379, Social Security Wage and Tax Statement, may be required when filing your New York State income tax return. If you are an F-4 or an F-5, the form may be filed with either or both of your tax returns. If you are an F-3 or an F-6, the form may be filed with only your tax return. For more information, see Publication 502, Tax Guide For Nonresident Aliens. For more information about the IRS Form 8379, visit the Social Security Wage and Tax Section web page at IRS.gov/ Social Security or the IRS website, Forms and Publications. You may also contact Social Security Online at or SSA.gov. The SSA also has forms to process filing and payment, Tax Return Estimation, and Filing Online. Line 29 — Fill out the New York State line 29 deduction. The federal New York State line 89 deduction will be used in calculating total tax withheld from your pay. If you do not select line 29, the state line 89 deduction will be taken automatically. Line 30 — Federal New York State line 29 deduction, if selected. Line 31 — Do it now! Your name will be entered on the New York State line 69 deductions, if selected, Line 30, and Line 29, if not selected. Please remember to check the appropriate box in the box provided on line 30.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form instruction 1040 Line 20a & 20b, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form instruction 1040 Line 20a & 20b online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instruction 1040 Line 20a & 20b by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instruction 1040 Line 20a & 20b from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing When to file Form instruction 1040 Line 20a & 20b