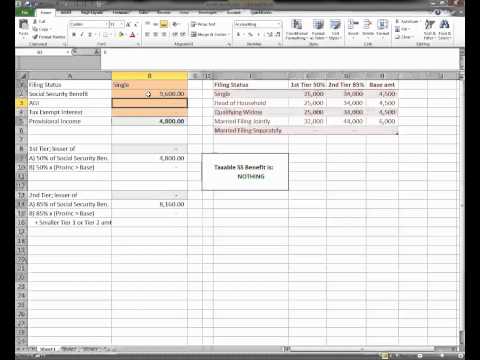

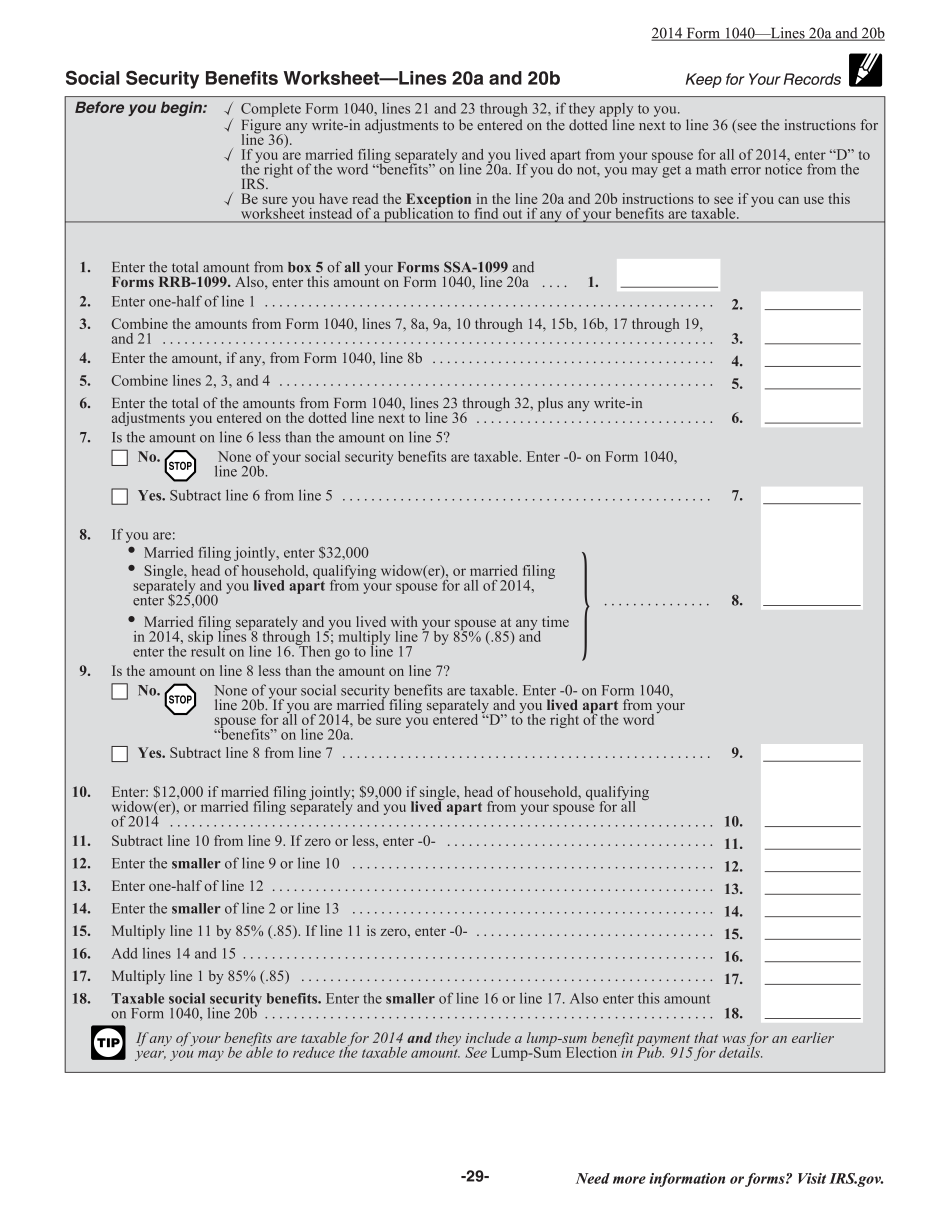

Hello, in this video, I will show you how to calculate the taxable portion of your social security benefit. Then, I will show you how to use this simple calculator that I created, which will do the calculation for you. To begin, let's go over how you would do it by hand. The first thing you have to do is calculate your provision no income. The provisional income is actually pretty complicated and is made up of several components. It includes your AGI, income earned from Puerto Rico and American Samoa, income earned while living abroad, and added back higher educational expenses. For the majority of people, none of these components will apply, but a very common one is tax-exempt interest. Your provisional income is calculated by adding your AGI, tax-exempt interest, and one-half of your social security benefit. Using that provisional income, you need to compare it to IRS set amounts based on your filing status. If your provisional income is less than $25,000, none of your Social Security benefit is taxable. If it's greater than $25,000 but less than $34,000, a certain percentage of your benefit is includable. Let's move over the table. For example, if you're single and your provisional income is less than $25,000, 0% of your Social Security is taxable. If you're single and your provisional income is between $25,000 and $34,000, up to 50% of your benefit is includable. If your provisional income is greater than $34,000, up to 85% is includable. For married filing jointly, the threshold amounts are higher. Let's move on to step three, which is to calculate based on the tiers mentioned in the previous step. If you fall into tier one, the taxable amount is the lesser of 50% of your social security benefit or 50% of the provisional income that is over the base...

Award-winning PDF software

Who needs instruction 1040 Line 20a & 20b Form: What You Should Know

If you have earned a Roth IRA. Do not use the “Complete Tax Forms” on this website to add these forms to the 1040, form 1040A, or other 1040 forms. Use Form 1099, W-2, or Form 1045 instead. Check the box at line 20b if you will receive medical benefits from an employer. 2021 Worksheet with checkboxes Use Worksheets for “How Do You Earn Your Own Retirement” and “How Do You Earn Your Own Retirement? 2021 New Jersey Resident Tax Return Worksheet with checkboxes Complete Form NJ-1040 to file your federal tax return(s) with the New Jersey Department of Finance. 2022 Taxable Pension, Annuity, and IRA Distributions/withdrawals for Married Taxpayers 2022 Taxable Pension, Annuity, and IRA Distributions/withdrawals Form 1040NRF. 2022 New Jersey Resident Tax Return. 2022 NJ Resident Return. The state uses IRS instructions on line 3 to fill out your returns. Follow the instructions to correctly identify the amount of your refund and fill out the appropriate tax forms. 2022 NJ Resident Return The state uses IRS instructions on Line 4 to fill out your returns. Follow the instructions to correctly identify the amount of your refund and fill out the appropriate tax forms. 2022 Taxable Pension, Annuity, and IRA distributions/withdrawals 2022 Taxable Pension, Annuity, and IRA distributions/withdrawals Form 1040NRF. 2022 New Jersey Resident Return. The state uses IRS instructions on Line 4 to fill out your returns. Follow the instructions to correctly identify the amount of your refund and fill out the appropriate tax forms. Note: If applicable, you may need help from an IRS-certified tax preparer such as one of the IRS Certified Public Accountants (CPA). A Tax Counselor may also be helpful in answering your questions. A good tax professional will also be able to create a customized return. Forms and Publications To download the latest versions of both of these books, go to Amazon and search for IRS Publication 547. Form 1040A, U.S. Individual Income Tax Return, Publication No. 547. Form 1040, Miscellaneous Income Tax Return, Publication No.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form instruction 1040 Line 20a & 20b, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form instruction 1040 Line 20a & 20b online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instruction 1040 Line 20a & 20b by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instruction 1040 Line 20a & 20b from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Who needs Form instruction 1040 Line 20a & 20b