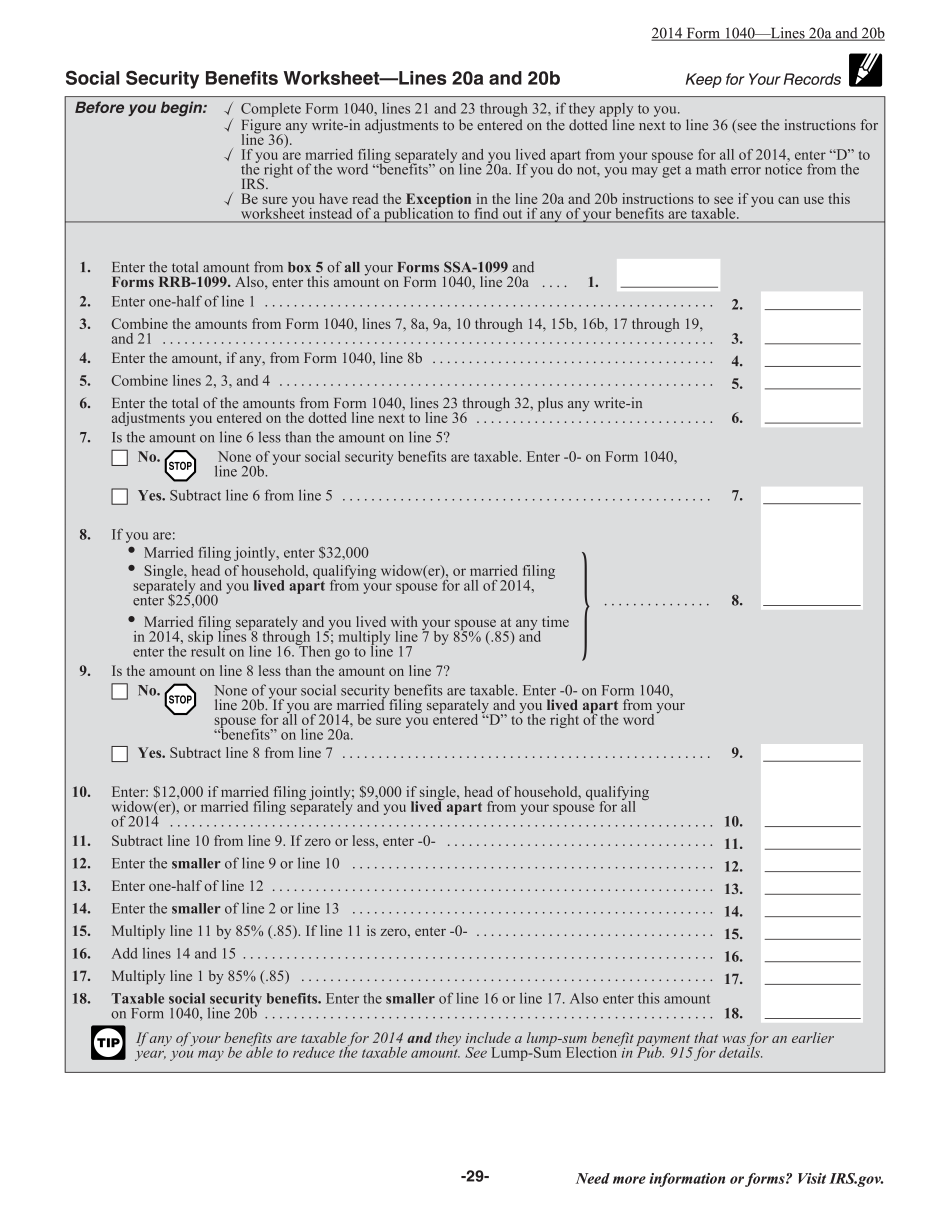

After completing Schedule II, we're back to Form 1040. If you receive Social Security benefits, you'll also receive a Form SSA-1099 that shows your total benefits for the past year. You'll have to list your total benefits on your 1040, and then you'll have to determine the amount of your benefits that are subject to income tax. This is the hard part. Social Security benefits were tax exempt through 1983. After 1983, up to 50% of Social Security benefits were subject to tax. Furthermore, the Clinton tax increase of 1993 raised the tax burden on Social Security recipients. With the Clinton tax increase, up to 85% of your Social Security benefits will be taxed. The determination of the amount of Social Security benefits subject to taxation is complicated, but here's a guide for you: if your so-called base income, which includes half of your Social Security and all of your otherwise tax-exempt interest, is under $25,000, your Social Security benefits won't be taxed at all. If your base income is higher than $25,000 (or $32,000 if you're married), anywhere from 50% to 85% of your Social Security benefits are subject to income tax. The exact calculation requires a one-page IRS spreadsheet and is a great example of how Washington brainiacs cook up tax schemes that make perfect sense to them but leave the rest of us scratching our heads.

Award-winning PDF software

2017 1040 lines 20a and 20b worksheet Form: What You Should Know

Credit Carry Forward The standard deduction for 2025 is 12,000. If you itemize, reduce your income by 4,050 (6,050 if married filing jointly). You may carry over to 2025 up to 4,050 of the following: Student loan interest Credit carry forward Enter the total of these amounts on Schedule A (Form 1040). You can use up to 2,500 of 2025 or 2025 medical expenses as medical expenses that are not deductible. These expenses (and the 2025 expenses you carry forward) must be medical expenses paid using a qualified health plan. The plan must be approved and in effect by IRS tax law. If you enter medical expenses in 2018, you can include any itemized deduction on Schedule A (Form 1040). The exception is expenses that exceed 8.8 percent of your adjusted gross income. Do not enter a medical expense deduction on Schedule A (Form 1040). Use the standard deduction only to figure your deduction for 2017. Other than the standard deduction, you may deduct a fraction, e.g. 931.20, on Schedule A (Form 1040). However, you must use the same fraction you would use to figure itemized deductions on Schedule A (Form 1040). It is not possible to deduct the interest, expenses of building, and mortgage payments on a mortgage used to purchase a principal residence, even if you are married and file a joint return. 2017 Schedule A (Form 1040) — “The Deduction for Medical Expenses” and “Deduction for Student Loan Interest” Medical and Student Loan Interest Deduced From Income Enter the amount deducted on line 4a (for medical expenses) and 4c (for student loan interest) on line 8 of the Schedule A. You can use these amounts instead of the standard deduction. Use the standard deduction (Form 1040) for medical expenses (line 3) only. Other than the standard deduction, you may deduct a fraction, e.g. 900, on Schedule A (Form 1040). However, you must use the same fraction you would use to figure itemized deductions on Schedule A (Form 1040). Deduction for Medical Expenses — No Deduction for Student Loan Interest If you deduct the interest or expenses of a student loan for medical purposes, you must reduce the amount of your deduction for this purpose by the amount of interest or expenses. The deduction is limited to 30 percent, or 900.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form instruction 1040 Line 20a & 20b, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form instruction 1040 Line 20a & 20b online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instruction 1040 Line 20a & 20b by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instruction 1040 Line 20a & 20b from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 2025 form 1040 lines 20a and 20b worksheet