In today's video, we will continue the discussion on Social Security benefits. Specifically, we will talk about how and when Social Security benefits are taxed. When I mention social security taxation, I am referring to the taxation of your actual Social Security benefits, not the FICA payroll tax. During your working career, you contribute to the system through your FICA tax, with 6.2 percent going towards Social Security and your employer contributing another 6.2 percent. If you are self-employed, you are responsible for both contributions, totaling 12.4 percent. However, this is not what we are discussing here. We are focusing on taxes on your benefits in retirement. Whether your Social Security benefits are taxed or not depends on your provisional income. Provisional income is an IRS term and there is a specific formula used to determine if your benefits will be subject to taxation. Let's take a look at the provisional income formula. This formula considers various sources of income, including taxable investments such as stocks, bonds, and mutual funds. It also includes earned income, rental income, and interest earned from municipal bonds, even though municipal bonds are exempt from federal tax. The formula also takes into account the assets in your tax-deferred bucket, which could include retirement accounts like a 401k or IRA, as well as a pension. Additionally, 50% of your annual Social Security benefit is added to the calculations. Adding these numbers together gives you your provisional income number. If you have no retirement accounts, no pension, and no earned income, your Social Security benefit will not be taxed. However, if you have done a good job of saving and preparing for retirement, it is highly likely that your Social Security benefits will be subject to taxation. For single individuals, if their provisional income exceeds $25,000, 50% of their...

Award-winning PDF software

Irs Social Security Worksheet 2025 Form: What You Should Know

See PDF above). Click Upload. Choose my print preferences. You will be prompted to fill in your date of birth, your place of birth. You are required to write this information on your file. You can upload .dot files to the application, but the most convenient option to be sure it is as completely filled out as possible is to print the .dot file and then save an .pdf file based on the color signature and the .dot file. Choose My Documents. Click “Add to My Documents”. Fill out the document and sign. Print PDF (if you choose to download a .pdf file). You may receive your file in several formats: Plain text; .dot format; or, A2 Plain text or A3 font. Make sure your file is in the same format as the one you created in step 1. Please do not submit your file without a valid signature. For a description of the various types of documents that are available to download from this website please click here. Click Here to Download Std 678 Application Std 678 Work Authorization If you are a student who is not currently at high school, you can apply for Std 968, Work Authorization, using the following process: STEP 1 — Print the Std 968 Work Authorization Form STEP 2 — Fill Out the Std 968 Authorization Statement STEP 3 — Submit the completed Std 968 Authorization Statement to Department Of Business Oversight Step 1 — Print the Std 968 Work Authorization Form The Std 968 Authorization Statement is used by the Department of Business Oversight as additional employment verification that the holder of the card has all necessary authorization to enter the work authorization program. The statement must be signed, stamped, or stamped (in color). The form must be hand delivered to the location where the employer has a card number.

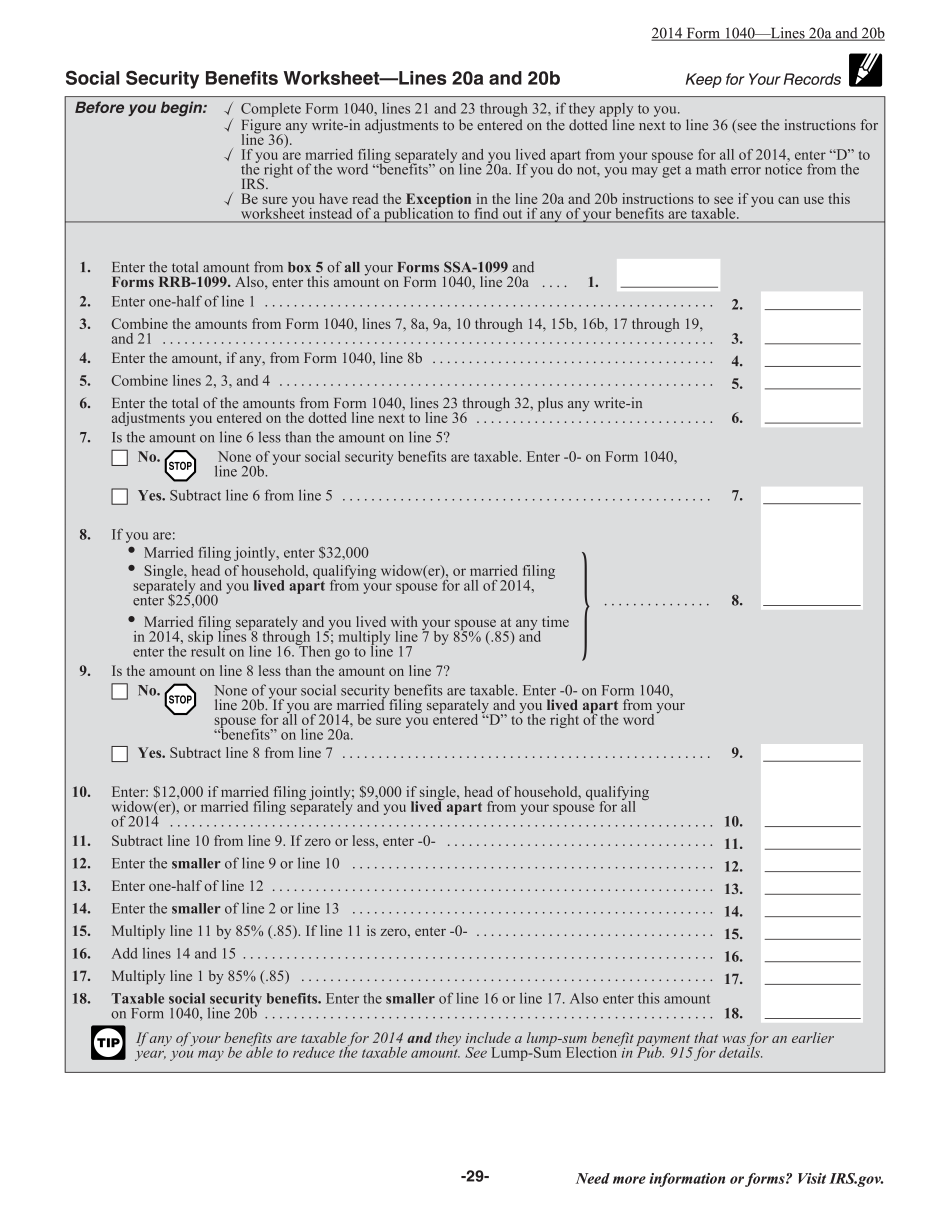

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form instruction 1040 Line 20a & 20b, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form instruction 1040 Line 20a & 20b online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instruction 1040 Line 20a & 20b by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instruction 1040 Line 20a & 20b from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Irs Social Security Worksheet 2025