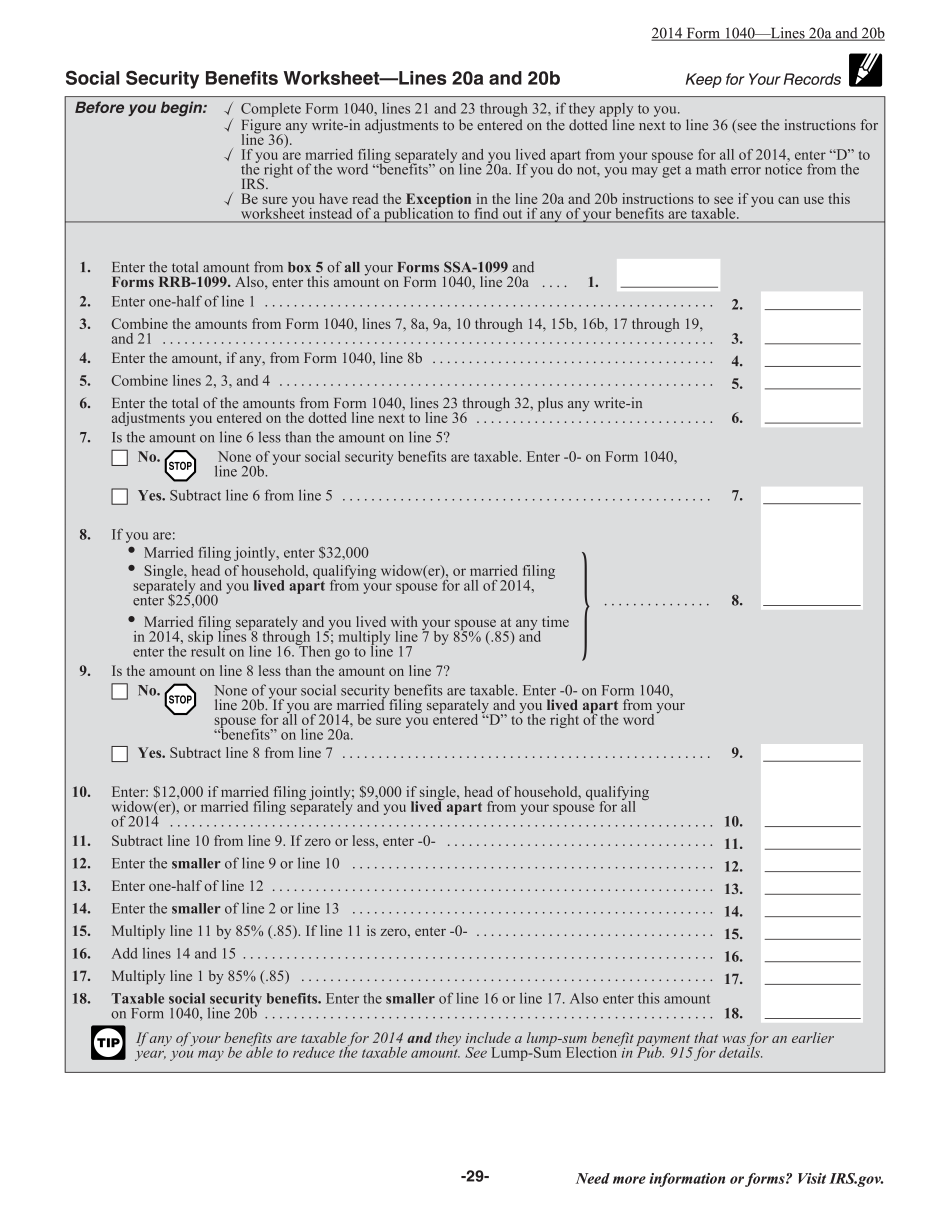

Hey everyone, this is Devin Carroll with Social Security Intelligence. Did you know that Social Security benefits were initially exempt from taxes? However, in 1983, they became partially taxable. Then, in 1993, a second income threshold was added, increasing the share of benefits subject to tax. Determining the taxable amount of your benefits and understanding how other sources of income affect this taxation is crucial when planning for retirement. In this video, I'll provide a step-by-step guide to help you figure out how Social Security benefits are taxed. First, I want to clarify that I am not affiliated with the Social Security Administration or any government entity. I am not here to provide specific tax, legal, or financial advice. The information presented should not be interpreted as such. I encourage you to seek advice from your own advisors in these areas. It often surprises people to learn that their Social Security benefits are taxable. After all, the benefits are paid from taxes collected from them. However, according to the Social Security Administration, 52% of families receiving benefits paid income tax on them in 2015. So, there's a good chance that some of your benefits may be taxable. Let's dive into the step-by-step process. Step one: Determine your provisional income. I will explain what this means shortly. Step two: Apply your provisional income to a tax grid. Don't worry, I will provide all the details and an example to help you understand. So, what exactly is provisional income? Investopedia defines it as the level of income used to determine if a taxpayer is liable for tax on their Social Security benefits and by how much. If your provisional income is low, you may not owe any taxes on your benefits. However, if your provisional income is high, up to 85% of your benefits could be taxed as...

Award-winning PDF software

Social Security Benefits Worksheet lines 20a and 20b 2025 Form: What You Should Know

Social Security benefits for a 2025 FICA tax year would be 6,600. On a 2025 Tax Return that is filed this July, the 2025 FICA benefit is 2,964, so the net income for line 29 (benefit computation). The federal tax benefit is 0.00 for 2017. The federal tax benefit is 0.00 in 2020. If your 2025 tax return had a 2,000.00 exclusion instead of tax year 2016, you could also use line 14a to determine your 2025 benefit. 2017 Publication 916 — IRS A similar worksheet to line 15 worksheets for the year 2025 and prior years on Line 14a. For years 2025 – 2018, it is important to understand the following. In 2015, if your total adjusted gross income for the year is 3900 or less, you don't owe tax on your social security benefit. However, if your total AGI exceeds 3900, but that income is less than 49,750, you must pay tax on your benefit. So if you have AGI of 40,000 or more and the tax on your benefit is 400, you would have to pay taxes at the marginal rate of 28.6%. 2017 Publication 916 — IRS To compute the tax on your social security benefits, simply follow the instructions in the Worksheet 14a of the 2025 publication. If the income is over 36,500 in 2016, you may not owe tax, so you don't have to use Line 14a. If the income is under 36,500 you may owe tax so fill out Line 14a. Social Security Benefits Worksheet —Bold lines 15 and 15–Bent Lines 15 —Fill in one line. Line 15—fill in the total amount from line 1 before lines 14a and 14b.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form instruction 1040 Line 20a & 20b, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form instruction 1040 Line 20a & 20b online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instruction 1040 Line 20a & 20b by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instruction 1040 Line 20a & 20b from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Social Security Benefits Worksheet lines 20a and 20b 2025