Award-winning PDF software

2018 taxable social security Form: What You Should Know

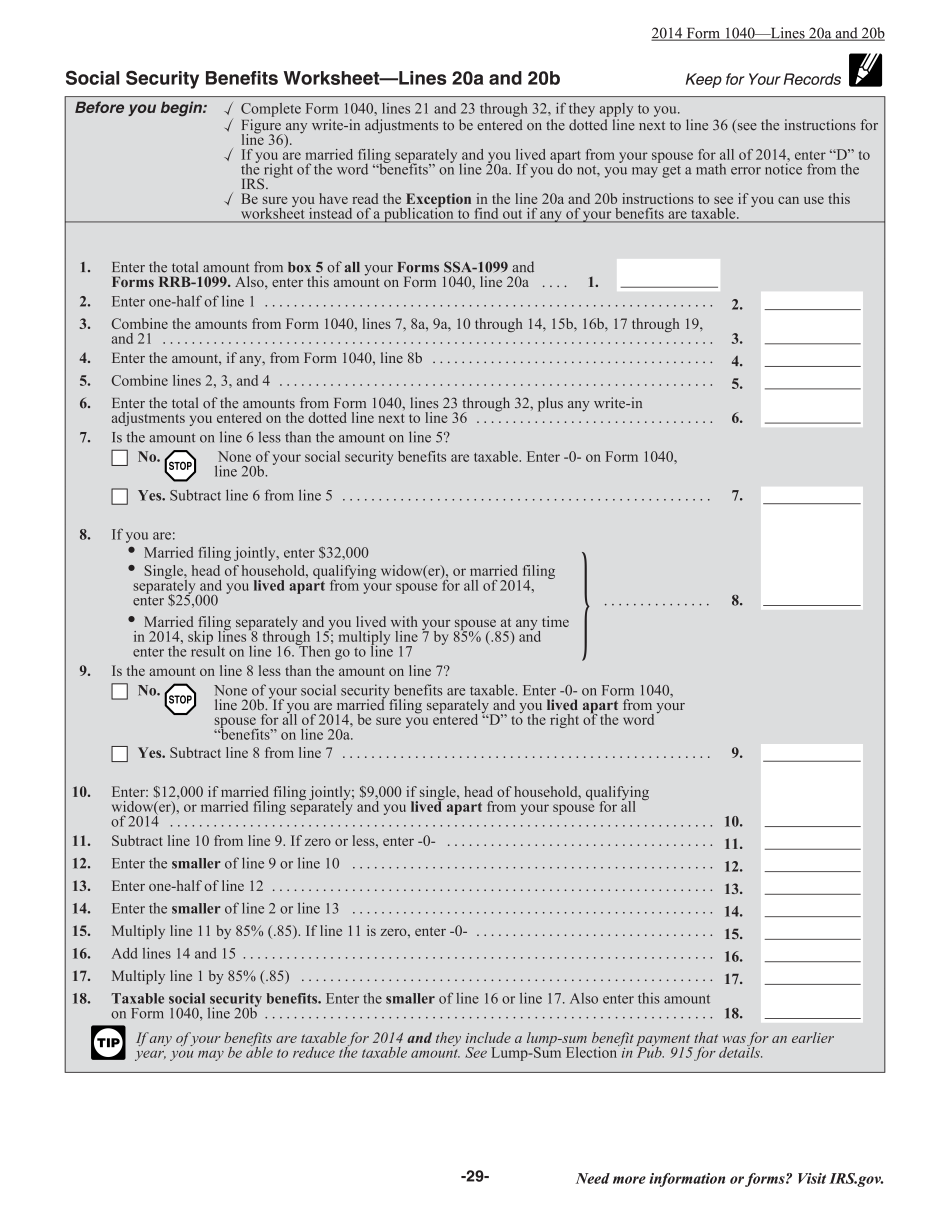

This document has instructions for filing your tax return. (The 1099 is different from the 1040.) The W-4 has a For an estimated date for payment, you'll also need to get a tax payment form. There's no tax penalty for filing early with your return for payment of withheld taxes. However, you'll be charged a late payment penalty for failing to file the correct form (Form 4868 for example). There is a special late filing deadline for filing a Form 4868 late or not timely. You do this if you did not file a Form 4868 for an expected social security benefit payment: March 1st, for people who need more time. You should get the Form 4868 from the IRS in late March. However, this deadline does not apply to a return that you filed under “reasonable cause and not more than 3 months earlier.” For example, if you filed your return earlier than 3 months, there's no later filing deadline for you. Also, do not take the penalty on any amount you withheld. You may only get back the difference (less the tax paid) if you can prove that you did withhold the correct amount. If your return is under reasonable cause and not more than 9 months later you may be able to go further. There's something called the “9-month filing deadline” that you can use to file your new return and claim an additional tax payment for withholding. You may need to claim a tax payment for withholding each time you change a tax assessment. The IRS may send you a Form 1099-K at the end of the year to show what you owe. It's the same type of Form 1099 you would normally get if you filed for the year, but you didn't file for the amount you owe. Do not file the return with a penalty — simply file it if you expect your check to come in the mail later that year. For More Information For a general discussion of filing a tax return, see the IRS website to see detailed instructions for filing your taxes. There is also a complete list of all the types of taxes the IRS can charge you, from a tax assessment to failure to file to under-reporting of wages to a substantial understatement of taxable income. The IRS website has more in-depth information about tax filing requirements, the assessment process, tax refund procedures, and a variety of forms and publications (in English and Spanish) covering the various tax areas you may owe.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form instruction 1040 Line 20a & 20b, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form instruction 1040 Line 20a & 20b online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form instruction 1040 Line 20a & 20b by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form instruction 1040 Line 20a & 20b from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.