Ca.gov Franchise Tax Board (FT) — What You Need To Fill Out Your Filing for

Ca.gov Franchise Tax Board (FT) — What You Need To Fill Out Your Filing for the Tax Year 2021 | FT.ca.gov What Is Filing a Tax Return For The 2018 Tax Year? Filing your 2018 tax return is easy. The FT is working on a system for tax returns that will be much easier than the paper forms we need in 2017. This system will automatically submit tax return information with the return (Form 100) and let you know if you are due a refund! When 2019 Tax Returns Are Available, The New System Will Help You! What do I need to fill out my 2018 tax return? Here is a complete list of the tax return items you must file in 2018. If you have other questions, please ask! 1. Filing Information & Filing Instructions. 2. Estimated Tax Payments. 3. Tax Bill. 4. Payment Information. 5. Your 2018 Tax Return (Form 100) 6. Summary of Payment Information. 7. Tax Due & Refund Information. 8. Filing a Proof of Tax Payment. 9. Tax Refunds, Adjustments, and Credit for Other Years! 10. Your 2016 Tax Return (Form 1040) 11. How to Use a Credit (e.g. Auctions, Leases) and the Child Tax Credit. Filing your tax return online in 2018 1. How to File a Schedule K-1. 2. How To Fill Out Your 2018 Tax Return. 3. Estimated Tax Payments. 4. Tax Bill. 5. Payment Information. 6. Schedule K-1 (Complete & Sign) 7. Summary of Payment Information. 8. Tax Due & Refund Information. 9. Filing a Proof Of Payment. 10. Your Tax Return (Form 100) Can I amend my 2017 tax return now ? I can't find the.

Ca.gov E-mail: The Franchise Tax Board (FT) conducts the nation's largest

Ca.gov E-mail: The Franchise Tax Board (FT) conducts the nation's largest voluntary assessment program that collects business franchise tax payments from state and local governments and uses these funds to help fund public benefit programs, provide training and education to improve compliance, and assist California's small businesses for compliance assistance and assistance in determining whether a business tax should be computed in California. The Franchise Tax Board determines which business categories and taxes should be calculated in California. The Franchise Tax Board administers the Business Franchise Tax Act to protect the public from fraud, deception, and evasion of business.

Kansas Franchise Tax Bulletin, 2010, Chapter 7 | Kansas Tax Bulletin, 2010

Kansas Franchise Tax Bulletin, 2010, Chapter 7 | Kansas Tax Bulletin, 2010, Chapter 8 565 | Kansascity.com Kansas Franchise Tax Bulletin, 2010, Chapter 9 565 | Kansascity.com Montana Franchise & Business Tax Bulletin | Department of Revenue. New Hampshire Instruction Manual | N.H. Department of Health. New Jersey Business and Professions Tax. 565 | N.J. Division of Taxation. New Mexico Franchise Tax (Provisional) Instructions for Schedule F-6 | Business.org Ohio Instruction Manual | Ohio Department of Taxation, Division of Taxation. Oregon Franchise Tax Bulletin, 2010, Chapter 6 | Oregon Business & Professions Tax Bulletin, 2010, Chapter 8 510 | Oregon Business.org Utah Instruction Guide | Utah Taxation Division. Vermont Instructions for Form RC-5 — Filing Requirements of the Special Franchise Tax Act 565 | VT.gov Wisconsin Franchise Tax and Division of Taxation. (Note that Wisconsin also has their very own version of the SBA's annual tax return forms — you'll find these in the Wisconsin chapter of the SBA's annual brochure — so be sure to consult that if you have questions or need additional info. NOTE: In Wisconsin, the franchise tax will be added to your gross receipts, unlike in most states. For that reason, you should think hard before accepting a lump sum check or the like from a franchisee. This can very quickly turn into big money.) 635 | Wisconsin Franchise Tax Administration. (Note that Wisconsin also has their very own version of the SBA's annual tax return.

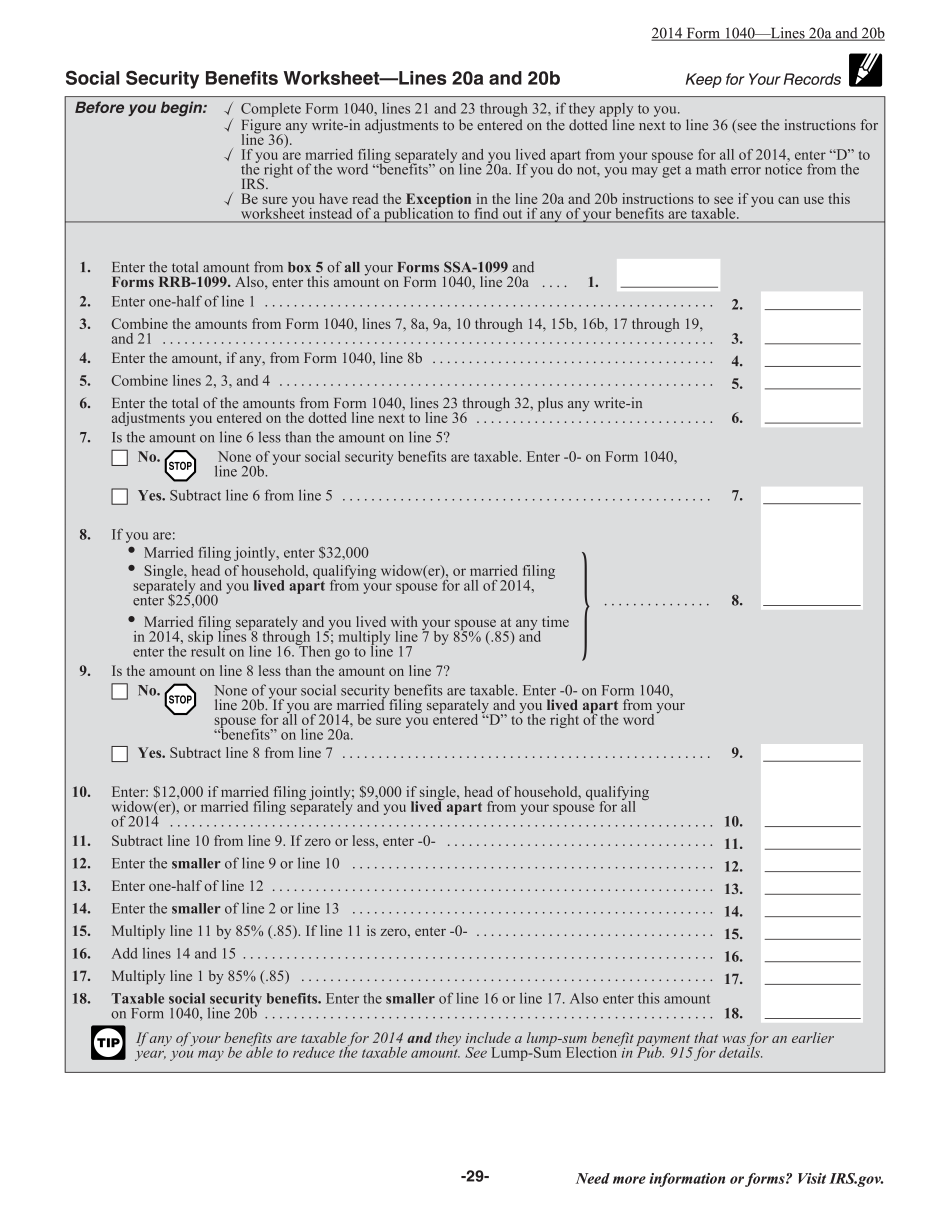

Other Benefits Forms And Information Social Security — Worksheet Medicare

Other Benefits Forms And Information Social Security — Worksheet Medicare — Worksheet Medicaid — Worksheet Food Stamps — Worksheet Child Support Order — Worksheet Military Support — Worksheet Overtime Pay — Worksheet Unemployment Insurance — Worksheet State Tax Benefits Tax Form 1040-C (TPA Statement) Tax Form 1040NR (Statement of Self-Employed) Tax Form 1040NRA (Statement of Dependents) Tax Form 2310 (Employer's Return for Taxpayer Withholding) The following forms can also be helpful or used as additional preparation: Social Security (Social Security Number) — You can use a Social Security Number to pay your taxes even if you don't have a bank account. You can find some Social Security Numbers on your tax refund check or online at Social Security.gov, which is operated by the U.S. Social Security Administration, which is part of the U.S. Department of the Treasury. Use your Social Security Number to check whether you are currently receiving benefits from social security (SSA) or medicare (meals, doctor visits and hospitalization), if you are an employee, and to report any federal and state income taxes you have to pay. Learn more. You can use a Social Security Number to pay your taxes even if you don't have a bank account. You can find some Social Security Numbers on your tax refund check or online at Social Security.gov, which is operated by the U.S. Social Security Administration, which is part of the U.S. Department of the Treasury. Use.

Award-winning PDF software