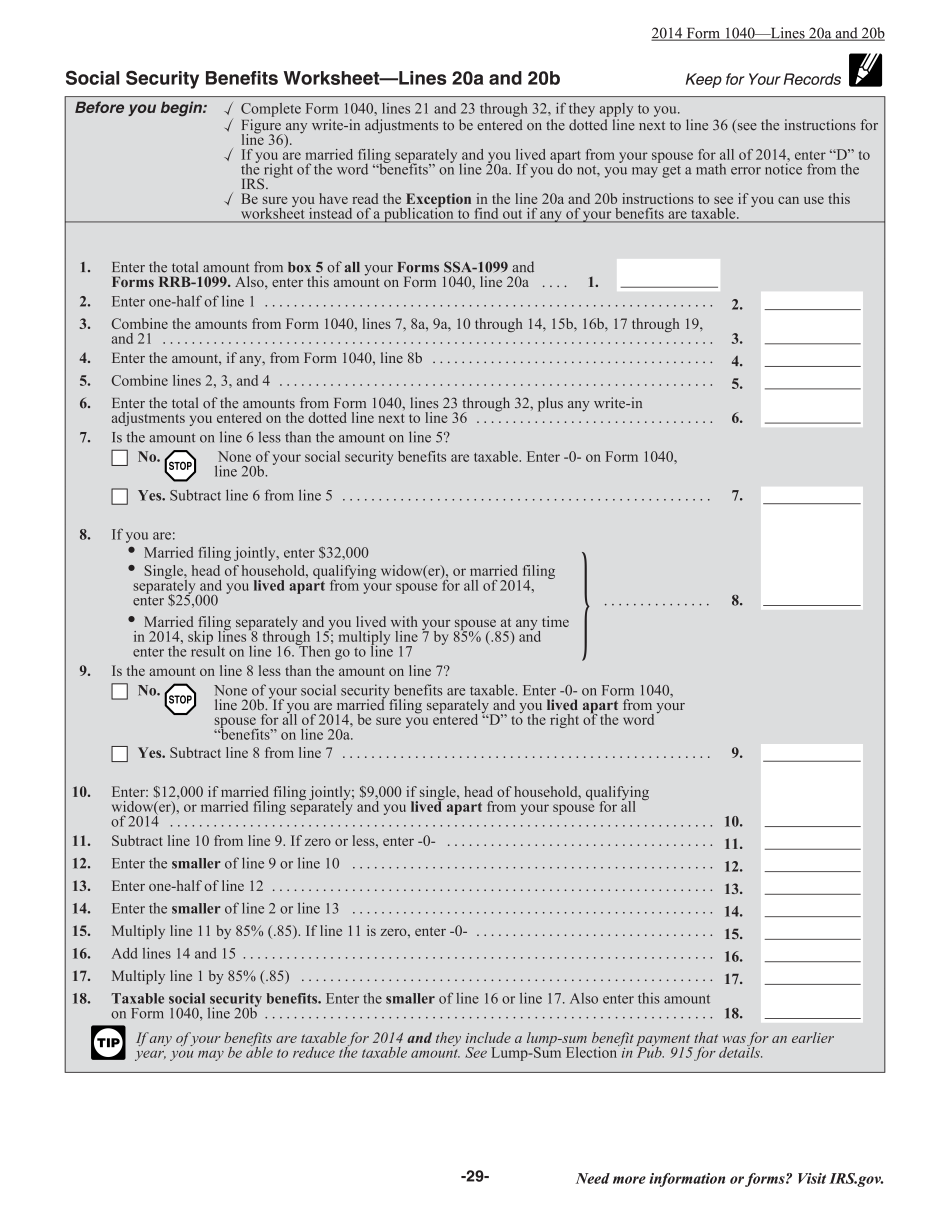

Form Instruction 1040 Line 20a & 20b and Form 1040: Basics

Increase Your Tax Refund With Above-the-Line Deductions

Forget about all those “tax breaks” you see all around us? Try to forget about them and focus instead on the basics you can do to lower your taxes. As your tax deductions become clearer and easier to use, they'll help you get even closer to the lowest possible tax bill. This guide outlines the five major deductions and credits you'll need in your personal financial statement, which you'll then use to work out how much you can get back in Federal Income Tax refunds. For example, these deductions can help: Pay off your debt. Lower mortgage interest for your home Protect your retirement savings Grow or save your retirement fund Retire more easily These five deductions and credits can easily result in a higher refund. And there are so many more deductions and credits that can help you lower your tax bill and take advantage of tax benefits such as the Earned Income Tax Credit. We've also created this handy infographic to help you decide which deductions are most important to you. For a more detailed breakdown, you can also consult our 2018 Filing Guide. Which Major Deductions Are Exempted? If you're not sure which tax deduction is being used to lower your tax bill, you can consult the IRS's list of exemptions and deductions. You'll find that most of them are tax-deductible, like medical expenses, charitable contributions, and deductions for state tax. However, you might find some of them are not deductible at all. For example, if you're an individual or an organization, you can generally deduct expenses that are not related to the specific thing you're claiming to be deductions or credits. But you can't deduct interest on loans to get education, nor do you have to pay taxes on your mortgage interest, etc. The IRS can be very lenient in this regard, but it's important to be sure to follow the rules. Which Expenses Are Eligible? Some deductions aren't deductible at all because they're intended to benefit the government or another group. You get this kind of deduction by filing as a member of a federal, state, or local military unit or organization. For example, if you donate time, products, or materials to your local police department or fire department, you can deduct those expenses. But not all types of expenses are specifically exempt from your deduction. You can always be the recipient of charity and tax deductions to reduce your tax

Form 1040: U.S. Individual Tax Return Definition, Types, and Use

A “tax return,” then, must be submitted to the IRS by an individual filing taxes for the year. This form is sent to the IRS by a taxpayer during the taxpayer's monthly tax response period, which is the time from the due date of filing the return to the payment of all the taxes due. The IRS uses its own rules when it determines which taxpayers fall within the monthly tax response period. Forms for Forms 1040 (Tax Returns) and 1040NR Use Form 1040, which can be mailed to the IRS or mailed to the address on the form. Form 1040 (Tax Returns) or Form 1040NR (NR1040NR) Form 1040, or Form 1040NR, can be sent to a tax processing facility in one of the following ways: The taxpayer can mail both forms directly to the IRS. Mail the form with an itemized statement of income and expenses to the address on the form. (See U.S. Filing Tips at page 7 for information on mailing the form in person.) Mail the form with an itemization statement of income and expenses to the address on the form. The taxpayer also can mail the form electronically to the address on the form using the IRS' Secure Access for E-File Users (SAFE) service. . The IRS can mail both forms directly to the taxpayer. Mail the form with an itemized statement of income and expenses to the address on the form. The taxpayer also can mail the form electronically to the address on the form within 3 or 45 days of the taxpayer's filing due date. To help taxpayers with complicated transactions, or who have questions about mailers for electronic filing, ask them about the Electronic Data Retrieval Service (EARS) (Form W-6). Forms for Forms 1120, 1040A and 1040NR Use Form 1120, which can be mailed to the IRS or mailed to the address on the form. Form 1120 (Tax Forms) In some cases, taxpayers may still want to complete one form for both the 1040 and the 1120 form that the taxpayers filed using a different address on the 1040. Form 1120 should not be used only if the taxpayer did not use a different address on the 1040 and the 1120 forms. When filing the 1040 and 1120 together, send both forms as a single PDF, not one single

Award-winning PDF software