Award-winning PDF software

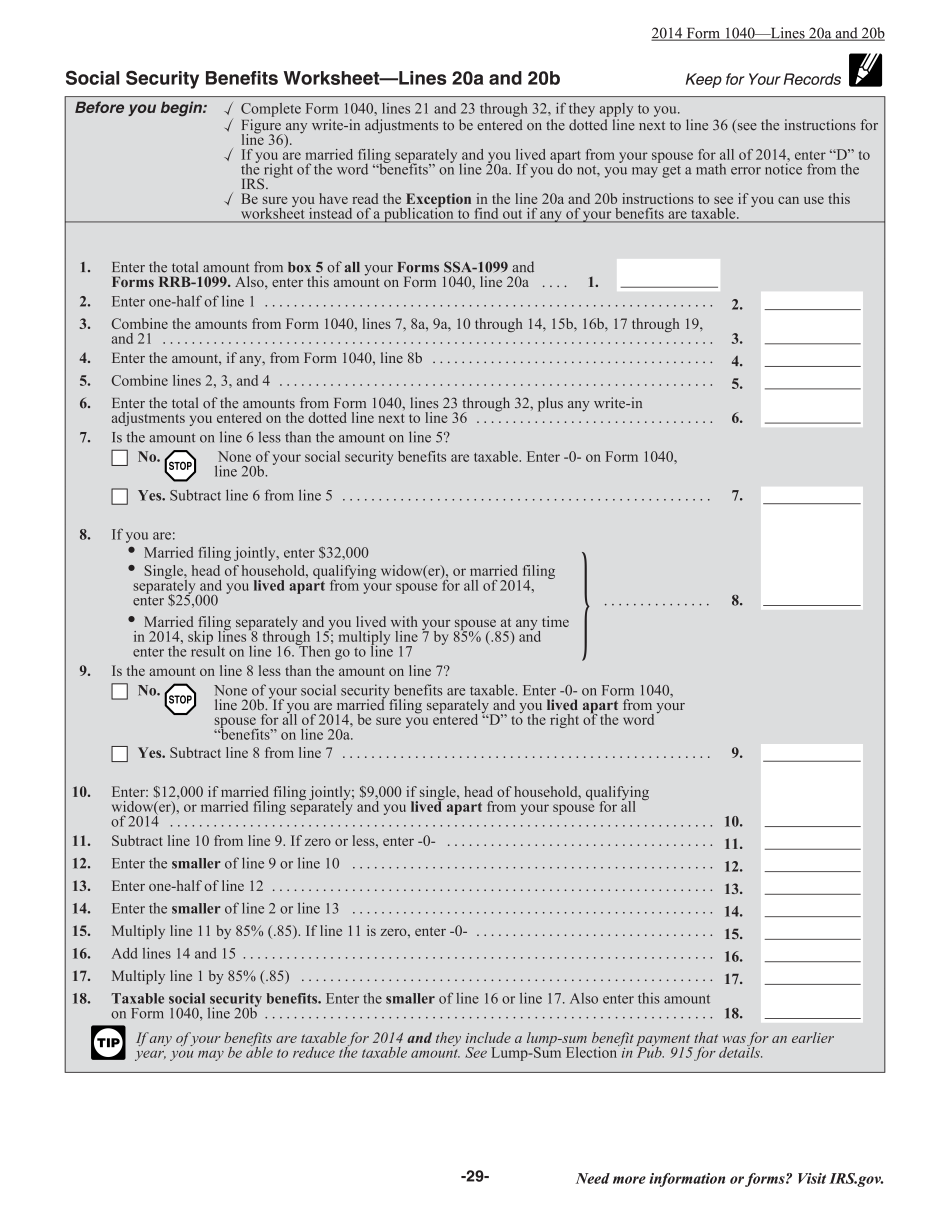

Form Instruction 1040 Line 20a & 20b Bridgeport Connecticut: What You Should Know

The 2025 Connecticut Individual Income Tax Return 2017 Connecticut Sales and Use Tax Instructions The Connecticut sales and use tax is imposed on property transferred from one taxpayer to another. The Connecticut sales and use tax rate is 3%. A business is entitled to deduct the tax you pay, and the sales/use deductions are allowed on Schedule K-1. Sales tax is imposed directly on the vendor when the purchase or exchange is made from the vendor to the customer, the supplier of property to the supplier, or when the property is delivered or manufactured to your place of business. The Connecticut sales and use tax rates are set annually by state government. Sales and use tax is collected at the end of the annual period, and is due on the following April 15. The dates that the sales and use tax is due are April 15 of each year for sales tax years that end in July, January, and February. For sales tax years that end in March, the due date is July 15 with the interest beginning the next Jan. 15 following the effective date of the tax. Sales tax rates vary from 1.60% to 9.50%. The rate may vary with the number of square feet, the location of your property, the kind and quantity of your product or services, the level of the service or product, your taxable gross receipts, where the customer is located, and the level of any additional services or product you offer. Your rate for 2025 is 12.50%. Sales tax is imposed on the full retail price of any product or service offered to your customers. No tax is imposed if your salesperson or your agent has engaged in transactions with the customer outside the Connecticut State Line or if the buyer is a resident of another state. You can choose to use either retail invoice or a cash purchase method of payment for your sales tax. Taxes and Licenses The Connecticut State Line is an imaginary line that divides the State of Connecticut from the State of Maine in the United States. This fictional line extends from Hartford, Connecticut to Portland, Oregon. The Connecticut State Line is the dividing line for the collection of sales tax on the sale, or rental, of tangible property that is located within the boundaries of Connecticut. This includes property leased, rented, or owned by a resident of Connecticut on a long-term basis. Vendors of tangible property whose tax assessment covers more than two counties may be required to collect Connecticut sales and use taxes in one or more counties.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form Instruction 1040 Line 20a & 20b Bridgeport Connecticut, keep away from glitches and furnish it inside a timely method:

How to complete a Form Instruction 1040 Line 20a & 20b Bridgeport Connecticut?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form Instruction 1040 Line 20a & 20b Bridgeport Connecticut aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form Instruction 1040 Line 20a & 20b Bridgeport Connecticut from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.