Award-winning PDF software

Form Instruction 1040 Line 20a & 20b for South Bend Indiana: What You Should Know

Services Division is responsible for: • collecting and processing Connecticut tax returns • issuing Connecticut tax notices and letters • processing Connecticut tax refunds for eligible taxpayers • performing audits of Connecticut tax returns • determining Connecticut tax status in cases of doubtful tax refund applications • administrating Delaware and other reciprocal agreements and treaties • assisting with various forms and programs to simplify tax applications • assisting taxpayers with tax payment processing in other non-Connecticut states and territories. Enter the total earned income on line 5 of the Form 1. Enter your child's tax exemption on line 5 of Schedule M. Enter the earned income plus the tax for the first 6 figures on line 21 of Form CT-1040 (line 19 on Connecticut tax return). 2022 Instruction 2025 — IRS 2022 Instruction 2025 — IRS Sep 18, 2025 — Enter the earned income on line 5 of the Schedule M. The same forms have to be used in line 24. Also, check the box next to “Do not include tax withholding” (line 21 of Form CT-1040). 2022 Instruction 2025 — IRS 2022 Instruction 2025 — IRS 1. Enter the tax withheld on line 23 of Form CT-1040. It should be a little less than the child's tax withholding tax. 2023 Instruction 2023— IRS Sep 21, 2025 — Line 24, “Total Income. Enter the total income from all lines.” Enter “No income” in the column for a child making 4,000 or less annually, “Total income” for a child making more than 4,000 and more than 10,000 annually, “Total income” for a child making more than 10,000 and all of his or her income from all lines and add lines 2026, 2030 and 2032 into one line for child making 2,500 to 5,000 annually. Enter zero for a child making less than 2,500 annually.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form Instruction 1040 Line 20a & 20b for South Bend Indiana, keep away from glitches and furnish it inside a timely method:

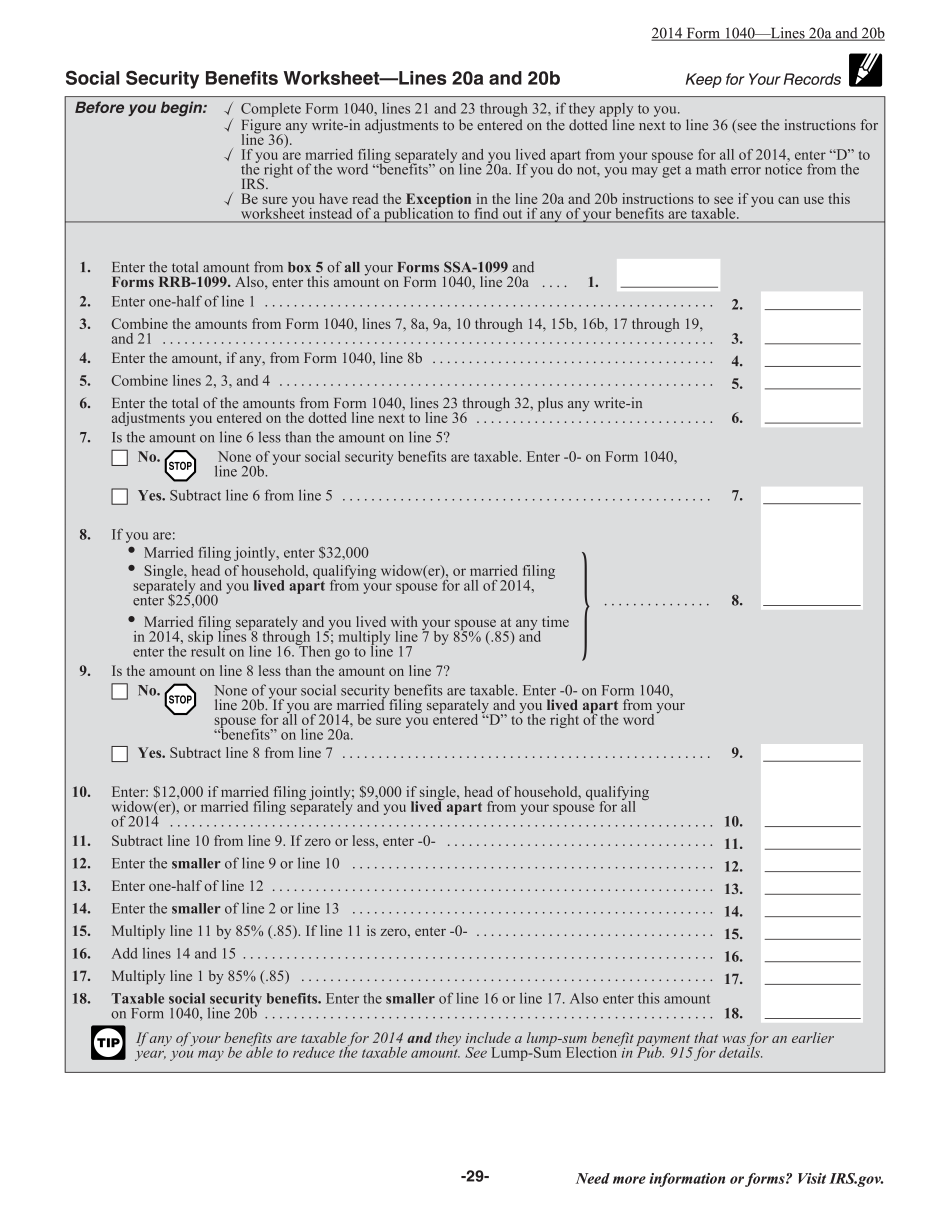

How to complete a Form Instruction 1040 Line 20a & 20b for South Bend Indiana?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form Instruction 1040 Line 20a & 20b for South Bend Indiana aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form Instruction 1040 Line 20a & 20b for South Bend Indiana from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.