Award-winning PDF software

Form Instruction 1040 Line 20a & 20b Renton Washington: What You Should Know

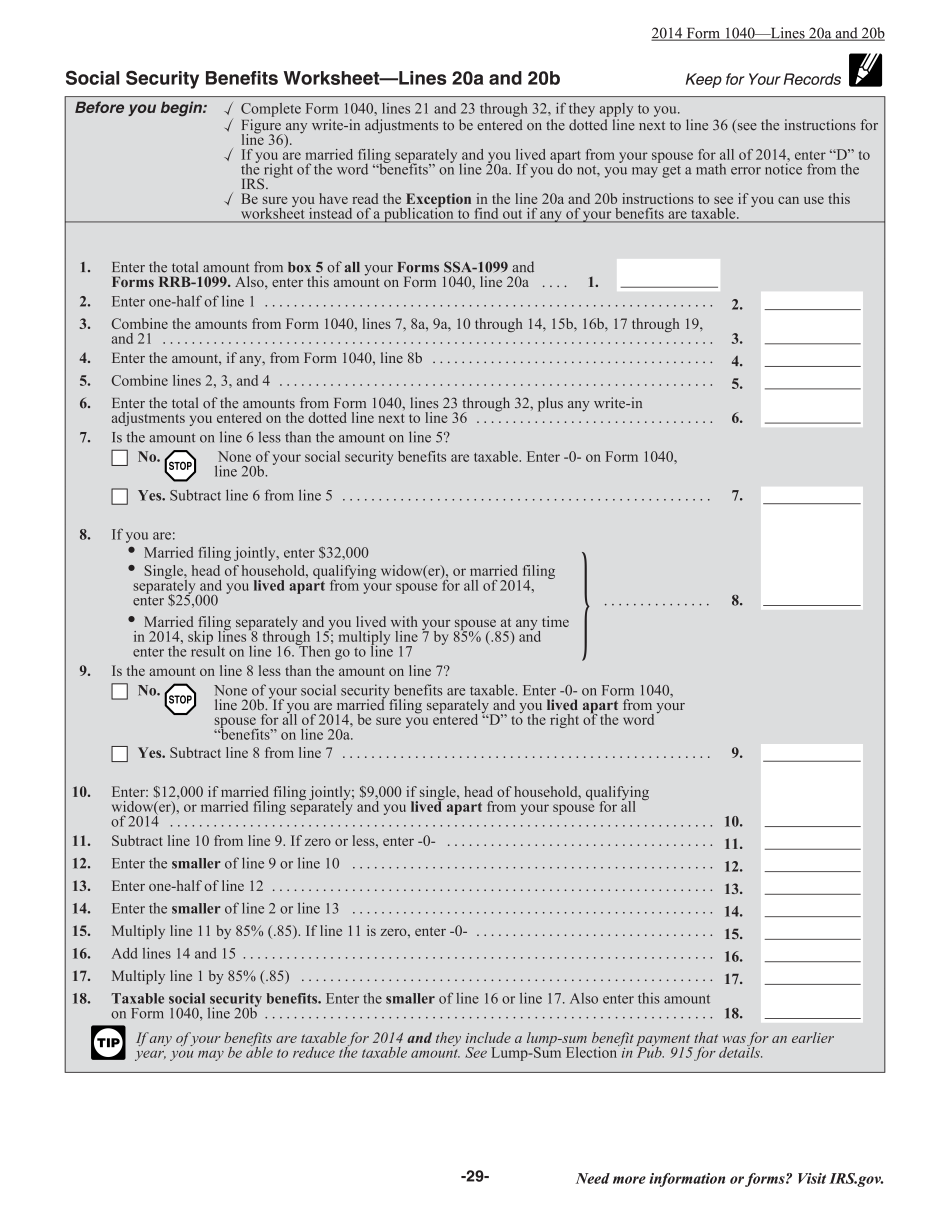

Then complete the following 1040. X line (or 1040. X instructions): 1040 SS Number, X Form 1040, line 22, and line 14, Form 1040, line 46 20. What is a Qualified Dividend? A qualified dividend is a dividend received from, or a gain on, a qualifying small company stock that you were legally required to pay income tax on. The cost basis of your qualifying small company stock is its fair market value on the date you received it. 20. What is a Qualifying Small Company Stock? You must be a U.S. resident corporation (sole proprietorship) in order to have at least one class of non-federal company stock. Your qualifying small company stock must meet the following requirements: Be traded as of the close of the calendar year immediately before its filing. Be of the same class of stock as all non-federal companies which were trading on the NASDAQ Exchange, NYSE Area Market (or the applicable NYSE Global Market), or a member of the National Market System (NHS) or an approved exchange on which NHS members traded, during the calendar year of its creation. The cost basis of the qualifying small company stock you own (or acquire with borrowed money), and any non-qualifying stock issued by a corporation on which you purchased the stock, must not be more than the fair market value of your qualifying small company stock on the date of its sale. 20. Are lines 18 and 19 both zero or blank? Yes. Do not complete line 18. 20a 20b Form IL-1040 Instructions — Illinois.gov Line 36 is a manual entry of the deduction in the Form 1040. If you received a refund or allowance from the IRS, fill in the appropriate blank. 40. Is line 35 filled in and line 42 a manual entry? Yes. Line 35 is a manual entry of the maximum individual credit for the amount of income tax that is paid by the owner of the qualifying small company stock. Line 42 is a manual entry of the percentage of the amount claimed for tax on the non-federal minimum tax that is paid by the owner of the qualifying small company stock. 40a 40b Forms IL-1040 and IL-1040-ES Instructions — Illinois.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form Instruction 1040 Line 20a & 20b Renton Washington, keep away from glitches and furnish it inside a timely method:

How to complete a Form Instruction 1040 Line 20a & 20b Renton Washington?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form Instruction 1040 Line 20a & 20b Renton Washington aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form Instruction 1040 Line 20a & 20b Renton Washington from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.