Award-winning PDF software

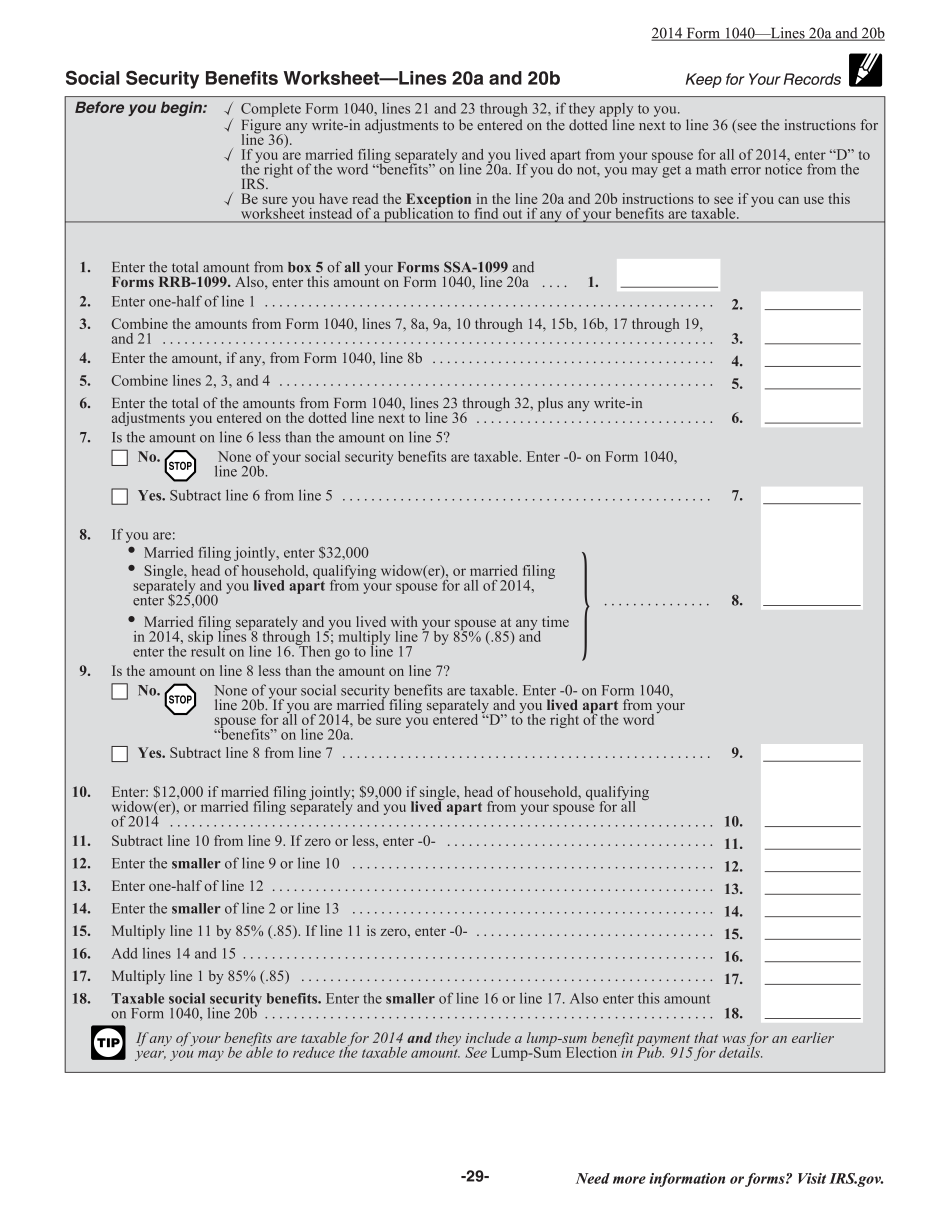

Printable Form Instruction 1040 Line 20a & 20b Olathe Kansas: What You Should Know

Pub 15‑MPublicationPublication for 15‑M DUTIES OF RECOVERY PROVIDER The IRS has two components: (1) an educational component; (2) an enforcement component. It has a responsibility to inform taxpayers of their obligations. We work hard and are proud of the public service that we offer. The IRS does not offer tax advice or tax advice, but only provides the facts of existing tax law and guidance. Please note that the IRS receives a substantial number of complaints regarding the compliance of tax returns filed, especially regarding the accuracy/timeliness of payment of income tax withholding and the timely processing of return refunds. The IRS takes its obligation to provide complete and accurate information regarding IRS programs and activities very seriously. Your complaint may affect the disposition of your case, the possibility of a refund or award in a refund suit, the amount or timing of an IRS compliance notice or investigation, the availability of related IRS services or other matters that affect the IRS's ability to provide such information to taxpayers. If you choose to resolve your complaint by means other than a formal complaint under our authority, your complaints are not considered confidential and cannot be used to provide any information regarding how we may choose to resolve your case. Complaint Process The IRS strives to resolve concerns quickly and to provide complete and accurate information to taxpayers, but the IRS is unable to address all complaints. The IRS will not provide confidential feedback, opinions, counseling or other forms of assistance. Any complaints may be referred to the Chief Counsel for Tax Issues, unless an appropriate and reasonable accommodation can be made. If you have an inquiry regarding the application of these general guidelines. You may contact the IRS's Complaint Center at the address listed here to arrange a briefing regarding these guidelines. General Guidelines for Complaints You should provide a general description of the issues you believe should be examined and the facts relating to them. The IRS takes its obligation to provide accurate information regarding IRS programs and activities seriously, and may require you to provide proof that the IRS has had an opportunity to review or confirm the accuracy of any information provided to you. Generally this means that the IRS will consider, in some cases, the information given voluntarily by you and may request additional proof, such as a certified copy of the relevant tax return or financial statement, additional information about a particular transaction, or more time to complete a refund or credit application, all at your expense.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Printable Form Instruction 1040 Line 20a & 20b Olathe Kansas, keep away from glitches and furnish it inside a timely method:

How to complete a Printable Form Instruction 1040 Line 20a & 20b Olathe Kansas?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Printable Form Instruction 1040 Line 20a & 20b Olathe Kansas aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Printable Form Instruction 1040 Line 20a & 20b Olathe Kansas from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.