Award-winning PDF software

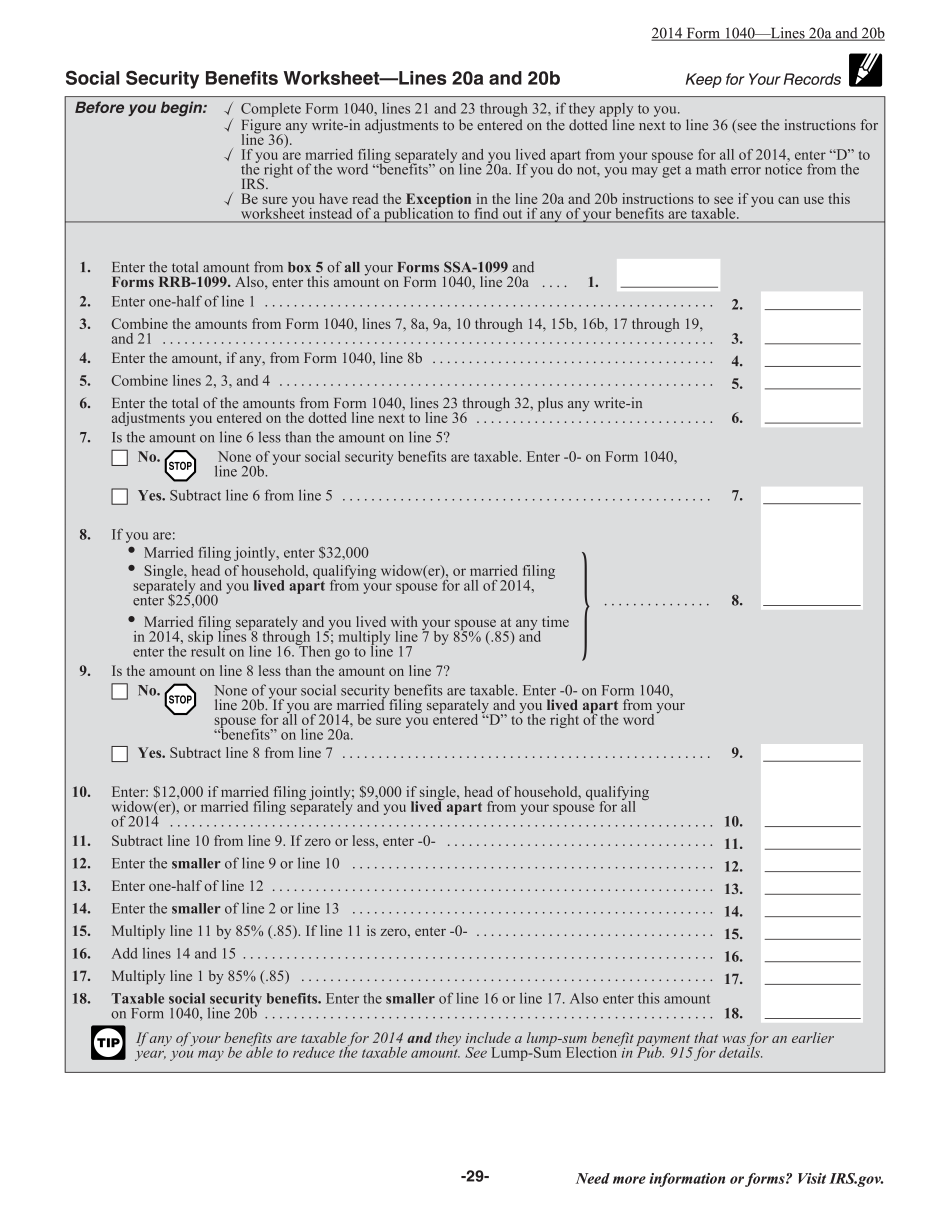

Wichita Kansas Form Instruction 1040 Line 20a & 20b: What You Should Know

Tax Tips for Business Owners | Current Tax Rates Current 2025 tax rates have been finalized. It appears that most of California's counties will not have any additional or higher tax rates for business owners in 2017. But, you still have to look over this list as these rates could change at any time. Tax Cuts for Individuals for Tax Brackets — Individual Income Tax Bracket Rate Changes Effective April 2025 The following individual brackets apply for 2017. The tax brackets are as follows: 15% from 0 to 7,300 25% from 7,300 to 19,700 33% from 19,700 to 77,700 35% from 77,700 to 150,000 37% from 150,000 to 300,000 38% from 300,000 to 450,000 10% for individuals who qualify for, and report, non-business personal income and/or non-business taxable income. Non-business personal income is income from a variety of sources, including rents, income from self-employment, wages, and alimony payments. These rates do not take into account any limitations or exceptions, nor do they include tax credits. The tax provisions that apply to non-business personal income are discussed below. Tax credits and deductions will be discussed in Part 3. Non-business taxable income is income from all sources, including dividends, capital gains, interest, annuities, pensions, gambling winnings, etc. Non-business taxable income is not income from an S corporation or an LLC, and it is not investment income such as interest. Income and deductions for businesses that are organized for business purposes. Businesses that are organized for business purposes. However, as discussed in the next section, the rules about this income are different for companies that are not businesses and for small businesses. Generally, small business owners will receive business expenses as they normally would. For these businesses, the tax rate for 2025 is 10%.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Wichita Kansas Form Instruction 1040 Line 20a & 20b, keep away from glitches and furnish it inside a timely method:

How to complete a Wichita Kansas Form Instruction 1040 Line 20a & 20b?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Wichita Kansas Form Instruction 1040 Line 20a & 20b aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Wichita Kansas Form Instruction 1040 Line 20a & 20b from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.