Award-winning PDF software

Form Instruction 1040 Line 20a & 20b Virginia Fairfax: What You Should Know

Use the form at. Virginia residents and Virginia taxpayers will now have the opportunity to get tax refunds online. Taxpayers in North Carolina, Arkansas, Florida, Georgia, Kentucky, Louisiana, Maryland, Mississippi, North Carolina, Oklahoma, South Carolina, Tennessee, Texas, Virginia and West Virginia have the opportunity to file online. (Click Here to see what the new Virginia Form 760 means. Click Here to view the new Virginia Form 760 instructions). Get Your Tax Refund Now! In an ideal world, you could keep paying at least a part of your federal income tax bill each year, but for many of us, this is not possible. That's why we have several plans to reduce your federal tax bill, starting today, and throughout the year. It's a smart choice to prepare your tax return with e-File (with us) which is one of the most cost-efficient tax preparation software out there. With a tax return can be prepared, filed and updated in under an hour. But that doesn't mean there are no taxes to pay. While we don't expect that most of our clients will file Form 1040X for our state tax deductions, we do expect that many of our clients will make use of their state tax credits and deductions. Our state tax calculator takes these deductions into account. E-Filing With filing If we haven't helped you already, I can tell you that now is the time to start getting the ball rolling. First, get your e-File software, which we also recommend Smart Tax. The software has been used successfully by thousands of customers and is available from most electronic retailers. Next, create a Account which is a free account created by the IRS that can be customized when you choose. This will allow you to save your forms or print them if necessary. Make sure to register your e-Filing software with us. It is free. Our Virginia taxpayers have used Smart Tax to file a state and federal tax return for the years 1998 to 2014. The Virginia returns that were filed were for filers that had filed a Virginia E-file return for 2013. For the 2025 return, the filing status and number of return filers were the same as when they filed the return for 2013. The tax information we received for 2025 was similar to what we are receiving from past e-file returns.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form Instruction 1040 Line 20a & 20b Virginia Fairfax, keep away from glitches and furnish it inside a timely method:

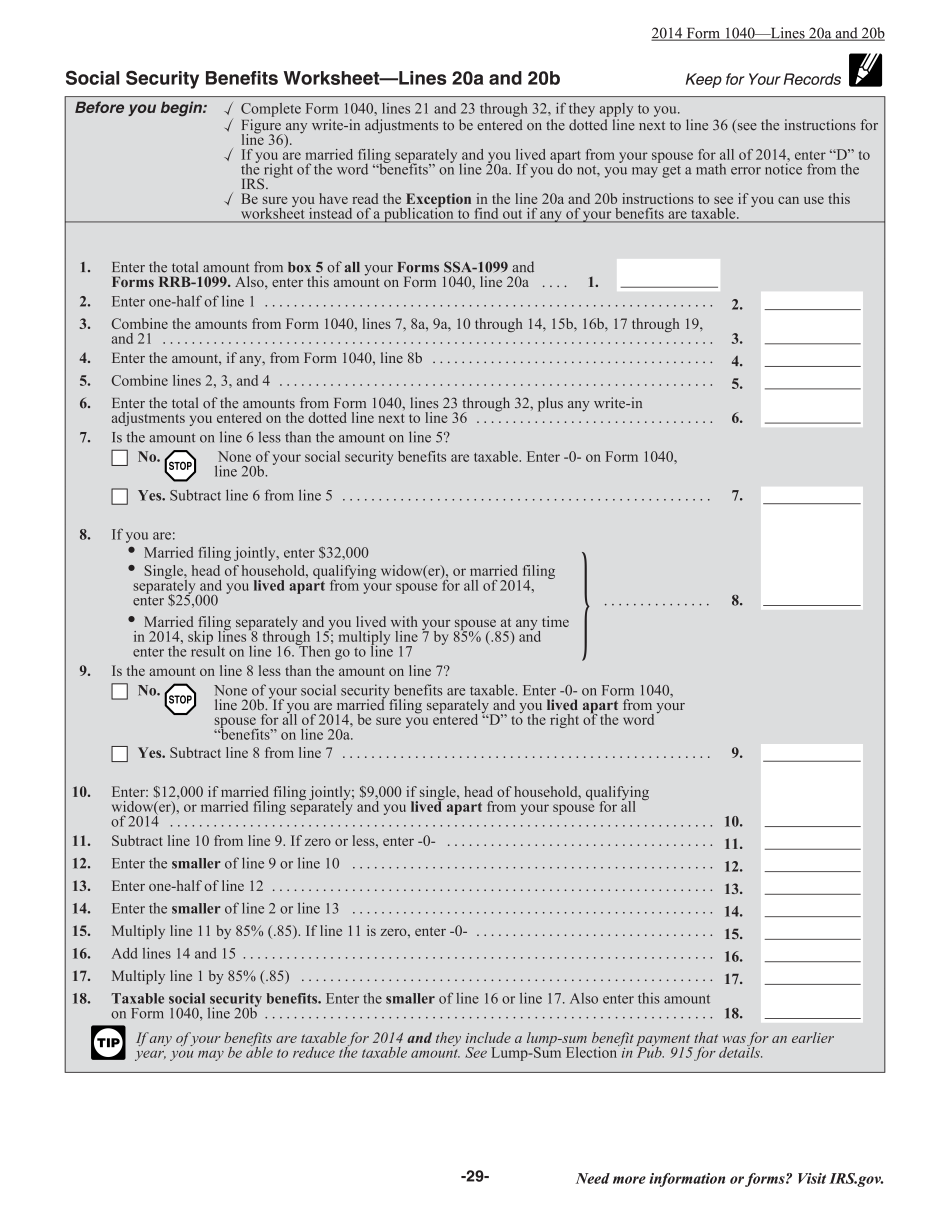

How to complete a Form Instruction 1040 Line 20a & 20b Virginia Fairfax?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form Instruction 1040 Line 20a & 20b Virginia Fairfax aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form Instruction 1040 Line 20a & 20b Virginia Fairfax from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.