Award-winning PDF software

Form Instruction 1040 Line 20a & 20b Minnesota: What You Should Know

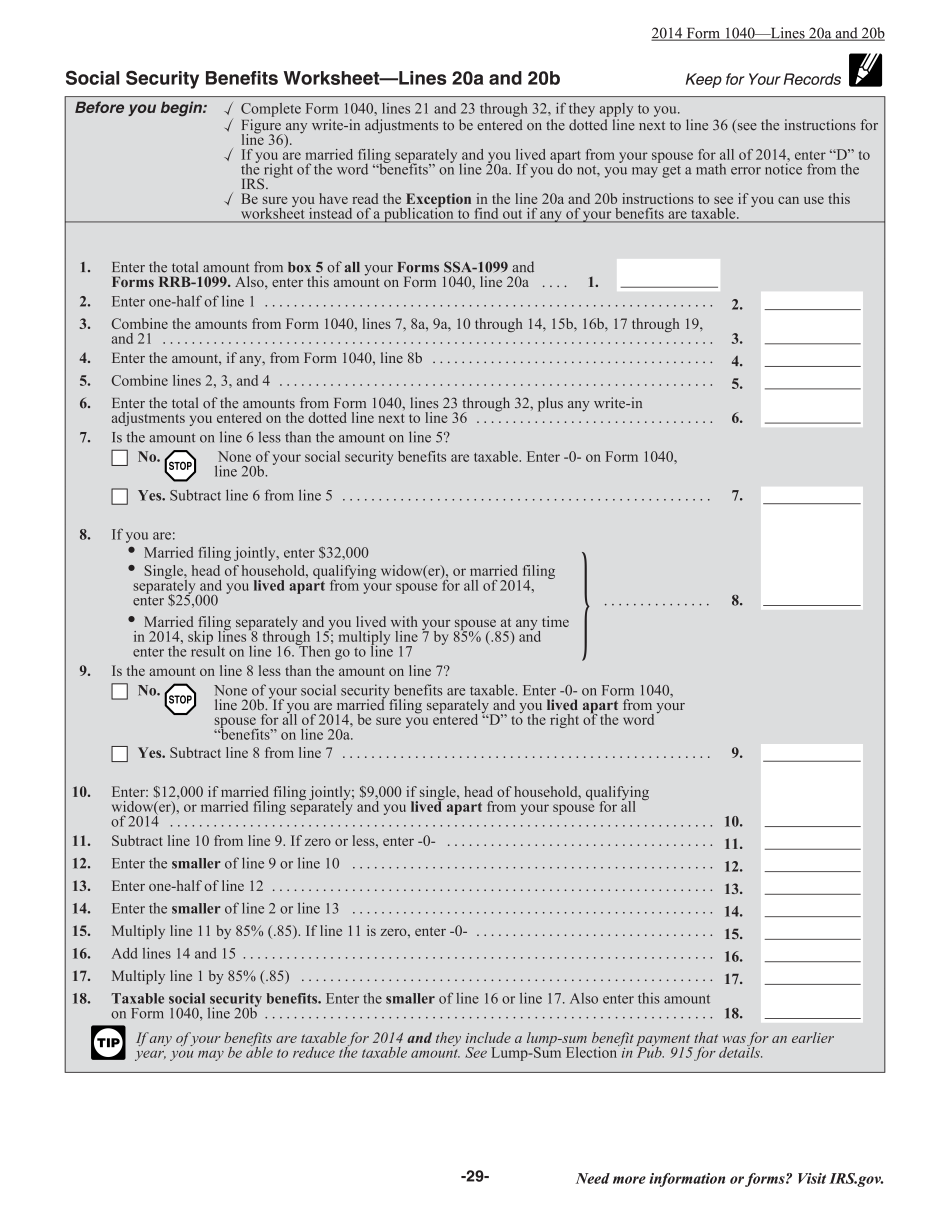

Enter your federal adjusted gross income (from line M1M, Income Additions and Subtractions Instructions 1 Multiply the number entered in box 6d of federal Form 1040 or 1040A by 4,050. . . 2 Enter your federal adjusted gross income (from line 20a and line 20b), including all adjustments to the adjusted income. Enter your total taxable amount on line 20a and report any excess amount on line 20b. Enter your total taxable amount on line 2021 Worksheets M1M, Income Additions and Subtractions Instructions 21 ING of lump-sum distributions. You can either use an online application or go to an authorized tax assistance center (ATC) for instructions. M1M, Income Additions and Subtractions Instructions Online Form JT2 You'll need a certified letter of tax advice from your physician if your child is: In a hospital. Or you're receiving care on a child-care and elder care basis. OR you're participating in an eligible program and a plan to provide supplemental security income benefits for a child of the eligible program participant who (but for the age adjustment) would be 14 years of age, or younger, was in foster care under the care of the applicant for at least 1 year before the date of the filing of the filing agreement. The plan can be a medical savings account, tax-advantaged college savings account, an IRA, or a qualified Tuition-Only tuition plan. Line 15 You must include a child-care expense on line 15. The expense must be for care provided on any day if it is related to a qualifying child. Line 9 You'll need the following with your return when filing Form JT2: (4) The total amount you paid on child support payments; (6) The total amount you paid on arbitrages in support in excess of arbitrages that were owing for tax years after 1998. Include the amount in box 12b; (7) Your child-care expenses received; (8) Your child's income before and after receiving the child care expenses. The income must be from the taxpayer's gross income. Include the total in box 12b of the Form JT2.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Form Instruction 1040 Line 20a & 20b Minnesota, keep away from glitches and furnish it inside a timely method:

How to complete a Form Instruction 1040 Line 20a & 20b Minnesota?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Form Instruction 1040 Line 20a & 20b Minnesota aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Form Instruction 1040 Line 20a & 20b Minnesota from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.